Authors

Summary

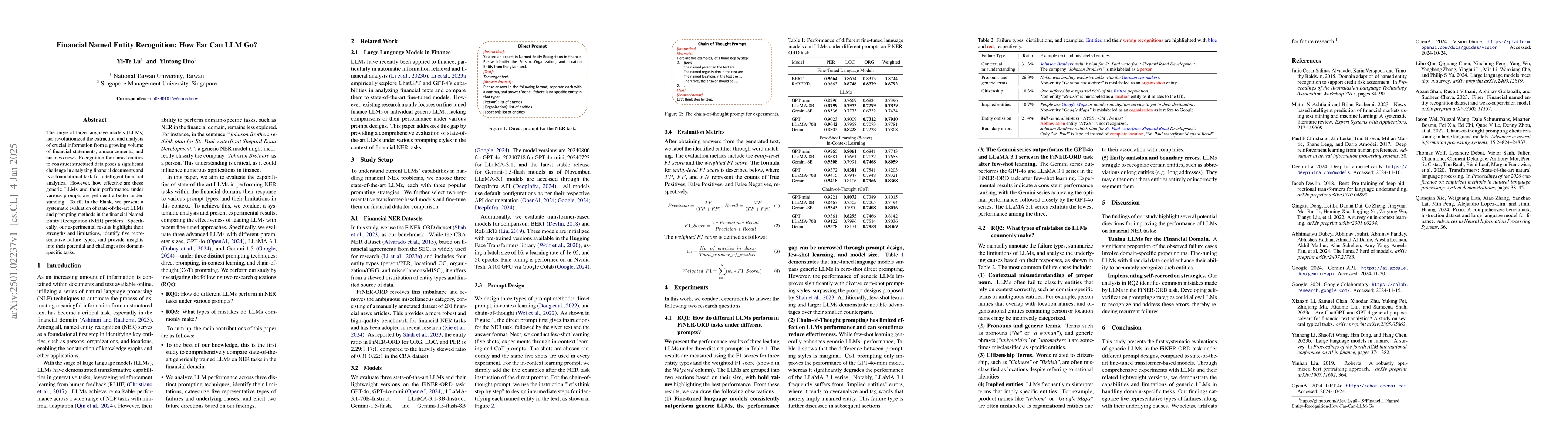

The surge of large language models (LLMs) has revolutionized the extraction and analysis of crucial information from a growing volume of financial statements, announcements, and business news. Recognition for named entities to construct structured data poses a significant challenge in analyzing financial documents and is a foundational task for intelligent financial analytics. However, how effective are these generic LLMs and their performance under various prompts are yet need a better understanding. To fill in the blank, we present a systematic evaluation of state-of-the-art LLMs and prompting methods in the financial Named Entity Recognition (NER) problem. Specifically, our experimental results highlight their strengths and limitations, identify five representative failure types, and provide insights into their potential and challenges for domain-specific tasks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Named Entity Recognition

Laure Soulier, Vincent Guigue, Tristan Luiggi et al.

Retrieval-Enhanced Named Entity Recognition

Raphael Y. de Camargo, Enzo Shiraishi, Henrique L. P. Silva et al.

Named Entity Recognition in COVID-19 tweets with Entity Knowledge Augmentation

Jiangming Liu, Xuankang Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)