Summary

A multitude of interconnected risk events -- ranging from regulatory changes to geopolitical tensions -- can trigger ripple effects across firms. Identifying inter-firm risk relations is thus crucial for applications like portfolio management and investment strategy. Traditionally, such assessments rely on expert judgment and manual analysis, which are, however, subjective, labor-intensive, and difficult to scale. To address this, we propose a systematic method for extracting inter-firm risk relations using Form 10-K filings -- authoritative, standardized financial documents -- as our data source. Leveraging recent advances in natural language processing, our approach captures implicit and abstract risk connections through unsupervised fine-tuning based on chronological and lexical patterns in the filings. This enables the development of a domain-specific financial encoder with a deeper contextual understanding and introduces a quantitative risk relation score for transparency, interpretable analysis. Extensive experiments demonstrate that our method outperforms strong baselines across multiple evaluation settings.

AI Key Findings

Generated Sep 29, 2025

Methodology

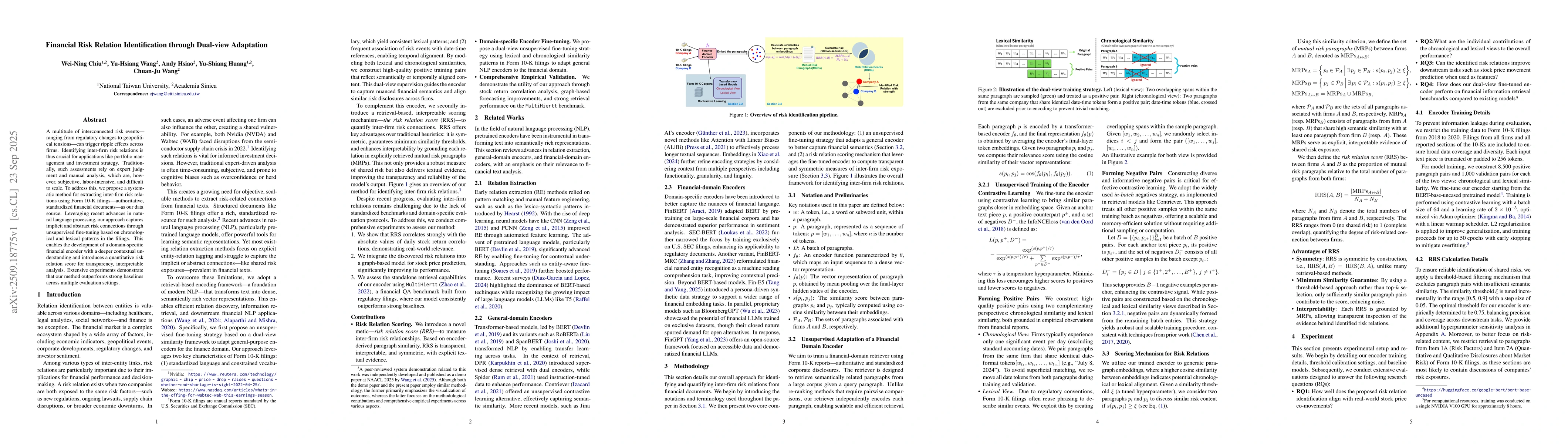

The paper proposes a dual-view adaptation approach using Form 10-K filings to identify inter-firm risk relations through unsupervised fine-tuning with chronological and lexical similarity views. It employs contrastive learning to train a financial encoder and computes risk relation scores (RRS) based on cosine similarity between paragraph embeddings.

Key Results

- The method outperforms strong baselines in multiple evaluation settings, achieving higher correlation with real-world stock price co-movements (ρ) compared to human-based and model-based baselines.

- The lexical view contributes more significantly to performance than the chronological view, though the dual-view approach achieves the best overall results.

- Integrating the risk relation metric into graph-based models like ADGAT improves stock price movement prediction by 2.3% in mean AUC.

Significance

This research provides a scalable, automated method for identifying financial risk relations between firms, enabling more transparent and interpretable risk analysis for portfolio management and investment strategies.

Technical Contribution

Development of a domain-specific financial encoder with dual-view (chronological and lexical) supervision for capturing implicit risk connections in financial texts, along with a symmetric, interpretable risk relation score (RRS) metric.

Novelty

The dual-view adaptation strategy combining chronological and lexical patterns from financial documents, along with the proposed risk relation scoring mechanism, represents a novel approach to automated financial risk relation identification.

Limitations

- The framework is specifically designed for risk-related exposures and may not generalize well to other types of firm interactions.

- Reliance on annual Form 10-K filings limits responsiveness to short-term market changes within a fiscal year.

- The method does not incorporate expert financial judgment, which is often critical in practical decision-making.

Future Work

- Integrating expert input to enhance interpretability and real-world applicability

- Expanding to other types of firm interactions beyond risk exposures

- Improving temporal responsiveness by incorporating more frequent financial data sources

Paper Details

PDF Preview

Similar Papers

Found 4 papersSingle-to-Dual-View Adaptation for Egocentric 3D Hand Pose Estimation

Yoichi Sato, Ruicong Liu, Mingfang Zhang et al.

Machine Learning based Enterprise Financial Audit Framework and High Risk Identification

Xi Zhang, Tingyu Yuan, Xuanjing Chen

Comments (0)