Summary

The financial rogue waves are reported analytically in the nonlinear option pricing model due to Ivancevic, which is nonlinear wave alternative of the Black-Scholes model. These solutions may be used to describe the possible physical mechanisms for rogue wave phenomenon in financial markets and related fields.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research proposes a nonlinear option pricing model (Ivancevic option pricing model) based on the modern adaptive market hypothesis, Elliott wave market theory, and quantum neural computation approach to describe financial markets' nonlinear complexity.

Key Results

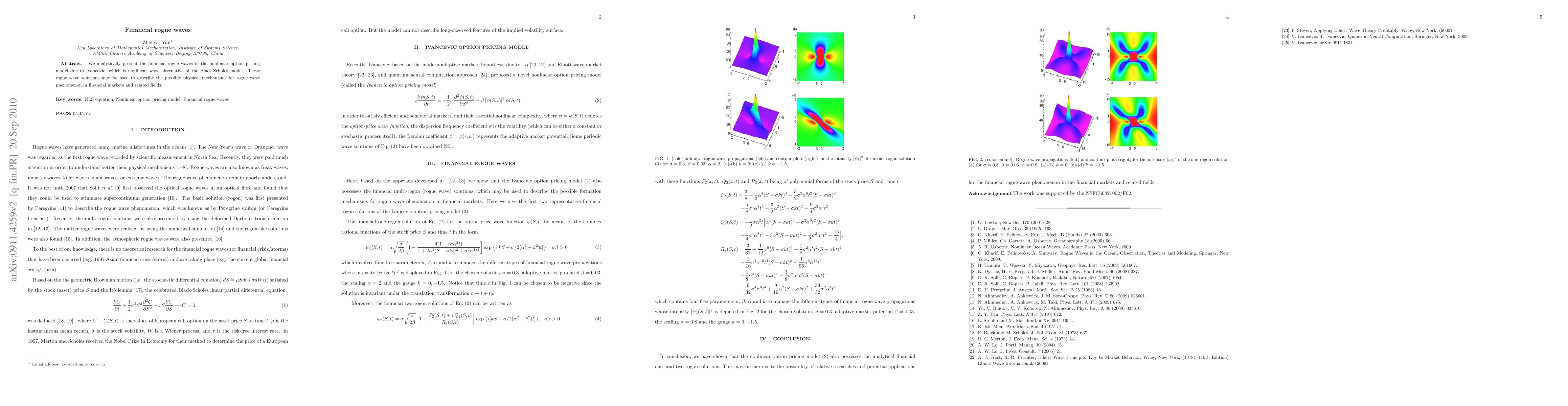

- Analytical financial one-rogue and two-rogue wave solutions are derived for the Ivancevic option pricing model.

- These solutions can describe possible physical mechanisms for rogue wave phenomena in financial markets.

- The model involves four free parameters (σ, β, α, and k) to manage different types of financial rogue wave propagations.

Significance

This research contributes to understanding and potentially predicting extreme events (rogue waves) in financial markets, which could have significant implications for risk management and investment strategies.

Technical Contribution

The paper presents an extension of the Black-Scholes model to a nonlinear wave alternative (Ivancevic option pricing model) capable of generating analytical rogue wave solutions in financial markets.

Novelty

This work is novel as it applies concepts from physical rogue wave studies to financial markets, providing a new perspective on extreme events in finance.

Limitations

- The model cannot describe long-observed features of the implied volatility surface.

- The study is theoretical, and practical validation in real-world financial markets is needed.

Future Work

- Further research could explore the practical application and validation of these rogue wave solutions in financial markets.

- Investigating the impact of these findings on existing risk management models and strategies.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRogue quantum gravitational waves

Azmi Ali Altintas, Fatih Ozaydin, Metin Arik et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)