Authors

Summary

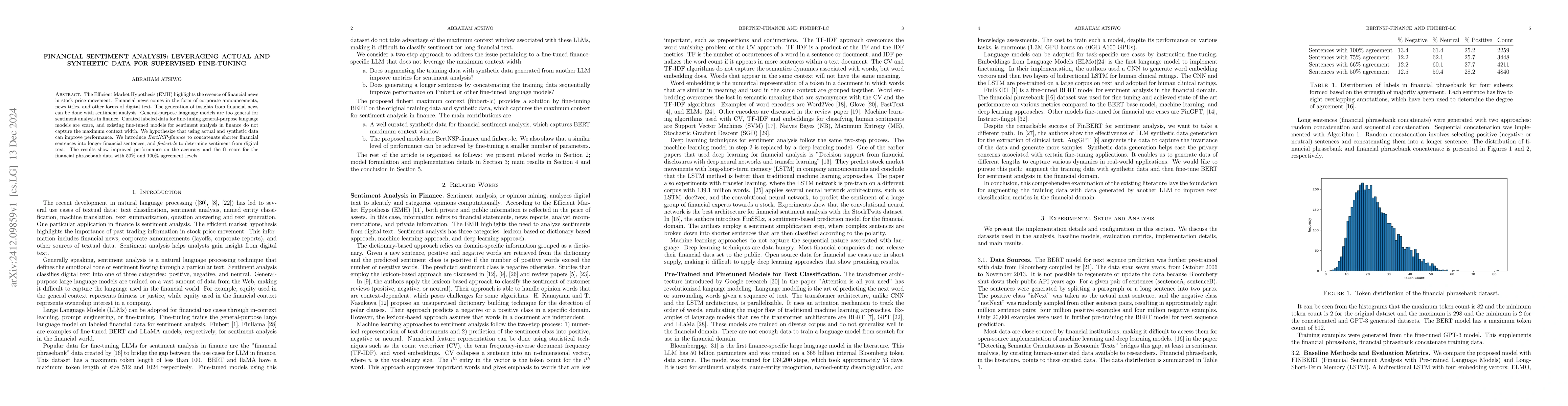

The Efficient Market Hypothesis (EMH) highlights the essence of financial news in stock price movement. Financial news comes in the form of corporate announcements, news titles, and other forms of digital text. The generation of insights from financial news can be done with sentiment analysis. General-purpose language models are too general for sentiment analysis in finance. Curated labeled data for fine-tuning general-purpose language models are scare, and existing fine-tuned models for sentiment analysis in finance do not capture the maximum context width. We hypothesize that using actual and synthetic data can improve performance. We introduce BertNSP-finance to concatenate shorter financial sentences into longer financial sentences, and finbert-lc to determine sentiment from digital text. The results show improved performance on the accuracy and the f1 score for the financial phrasebank data with $50\%$ and $100\%$ agreement levels.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research used a combination of actual and synthetic data for supervised fine-tuning of general-purpose language models.

Key Results

- Improved performance on accuracy and f1 score for financial phrasebank data with 50% and 100% agreement levels

- BertNSP-finance outperformed VanillaBERT Small and VanillaBERT Large in selected metrics

- finbert-lc performed better than LSTM with pre-trained embeddings for sentences with 50% and 100% agreement levels

Significance

This research is important because it contributes to the development of financial sentiment analysis models, which can be used for stock market analysis, algorithmic trading, and customer insights in banking.

Technical Contribution

The introduction of BertNSP-finance and finbert-lc, which improve performance in financial sentiment analysis

Novelty

This work is novel because it leverages actual and synthetic data for supervised fine-tuning of general-purpose language models, achieving state-of-the-art performance in selected metrics

Limitations

- The dataset used may not be representative of all financial news sources

- The models may not generalize well to new, unseen data

Future Work

- Exploring the use of other pre-trained language models for fine-tuning

- Investigating the effectiveness of different synthetic data generation methods

Paper Details

PDF Preview

Similar Papers

Found 4 papersFine-Tuning Gemma-7B for Enhanced Sentiment Analysis of Financial News Headlines

Chang Yu, Kangtong Mo, Wenyan Liu et al.

Instruct-FinGPT: Financial Sentiment Analysis by Instruction Tuning of General-Purpose Large Language Models

Xiao-Yang Liu, Hongyang Yang, Boyu Zhang

Transfer Learning with Joint Fine-Tuning for Multimodal Sentiment Analysis

Guilherme Lourenço de Toledo, Ricardo Marcondes Marcacini

No citations found for this paper.

Comments (0)