Summary

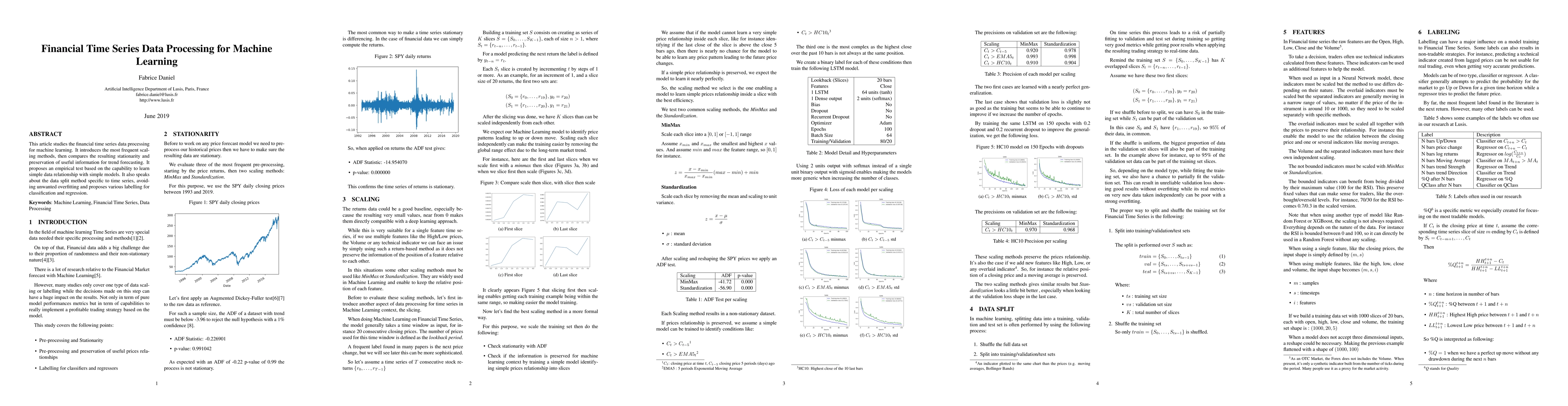

This article studies the financial time series data processing for machine learning. It introduces the most frequent scaling methods, then compares the resulting stationarity and preservation of useful information for trend forecasting. It proposes an empirical test based on the capability to learn simple data relationship with simple models. It also speaks about the data split method specific to time series, avoiding unwanted overfitting and proposes various labelling for classification and regression.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)