Authors

Summary

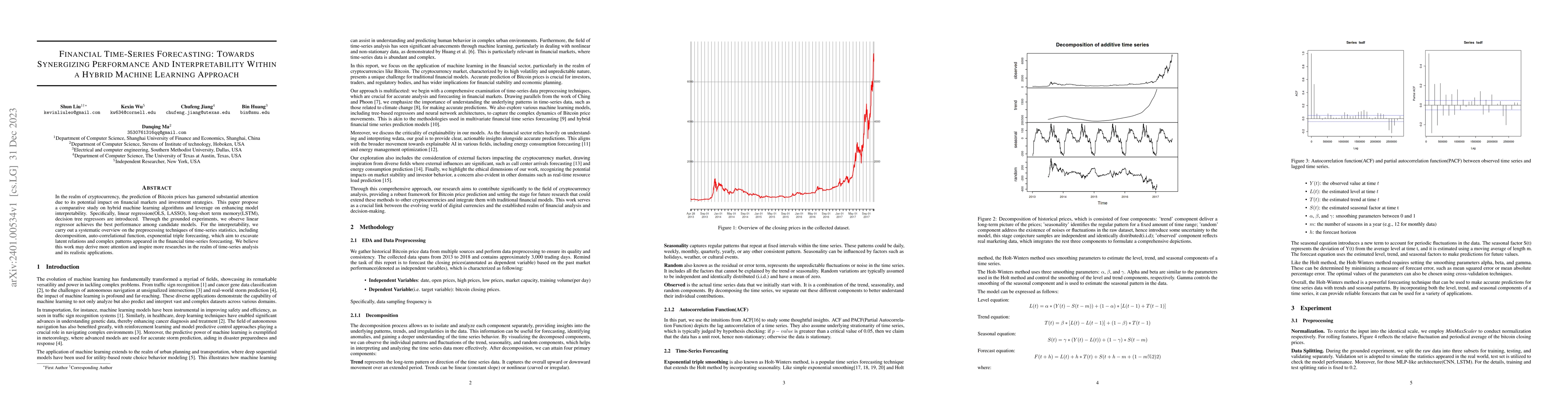

In the realm of cryptocurrency, the prediction of Bitcoin prices has garnered substantial attention due to its potential impact on financial markets and investment strategies. This paper propose a comparative study on hybrid machine learning algorithms and leverage on enhancing model interpretability. Specifically, linear regression(OLS, LASSO), long-short term memory(LSTM), decision tree regressors are introduced. Through the grounded experiments, we observe linear regressor achieves the best performance among candidate models. For the interpretability, we carry out a systematic overview on the preprocessing techniques of time-series statistics, including decomposition, auto-correlational function, exponential triple forecasting, which aim to excavate latent relations and complex patterns appeared in the financial time-series forecasting. We believe this work may derive more attention and inspire more researches in the realm of time-series analysis and its realistic applications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)