Summary

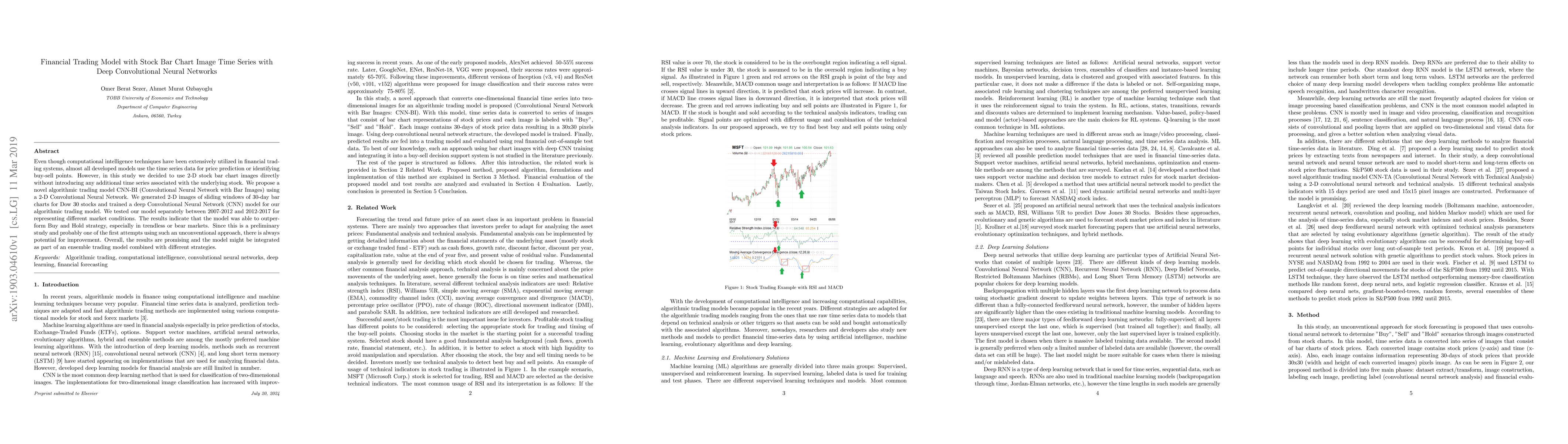

Even though computational intelligence techniques have been extensively utilized in financial trading systems, almost all developed models use the time series data for price prediction or identifying buy-sell points. However, in this study we decided to use 2-D stock bar chart images directly without introducing any additional time series associated with the underlying stock. We propose a novel algorithmic trading model CNN-BI (Convolutional Neural Network with Bar Images) using a 2-D Convolutional Neural Network. We generated 2-D images of sliding windows of 30-day bar charts for Dow 30 stocks and trained a deep Convolutional Neural Network (CNN) model for our algorithmic trading model. We tested our model separately between 2007-2012 and 2012-2017 for representing different market conditions. The results indicate that the model was able to outperform Buy and Hold strategy, especially in trendless or bear markets. Since this is a preliminary study and probably one of the first attempts using such an unconventional approach, there is always potential for improvement. Overall, the results are promising and the model might be integrated as part of an ensemble trading model combined with different strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCompatible deep neural network framework with financial time series data, including data preprocessor, neural network model and trading strategy

Mohammadmahdi Ghahramani, Hamid Esmaeili Najafabadi

| Title | Authors | Year | Actions |

|---|

Comments (0)