Summary

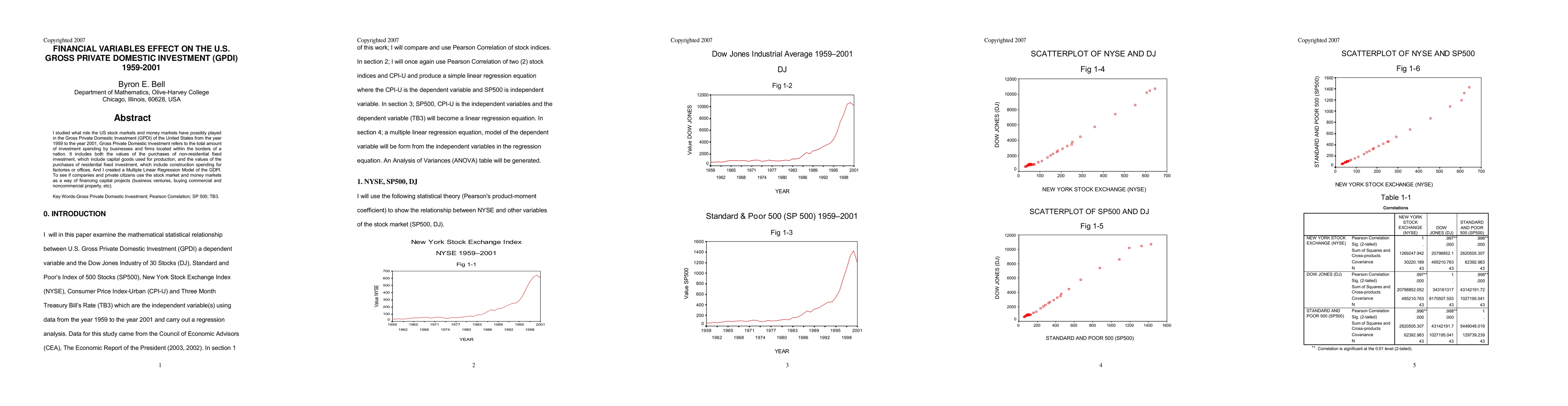

I studied what role the US stock markets and money markets have possibly played in the Gross Private Domestic Investment (GPDI) of the United States from the year 1959 to the year 2001, Gross Private Domestic Investment refers to the total amount of investment spending by businesses and firms located within the borders of a nation. It includes both the values of the purchases of non-residential fixed investment, which include capital goods used for production, and the values of the purchases of residential fixed investment, which include construction spending for factories or offices. And I created a Multiple Linear Regression Model of the GDPI. To see if companies and private citizens use the stock market and money markets as a way of financing capital projects (business ventures, buying commercial and noncommercial property, etc). Keywords: Gross Private Domestic Investment, Pearson Correlation, SP 500, TB3

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)