Authors

Summary

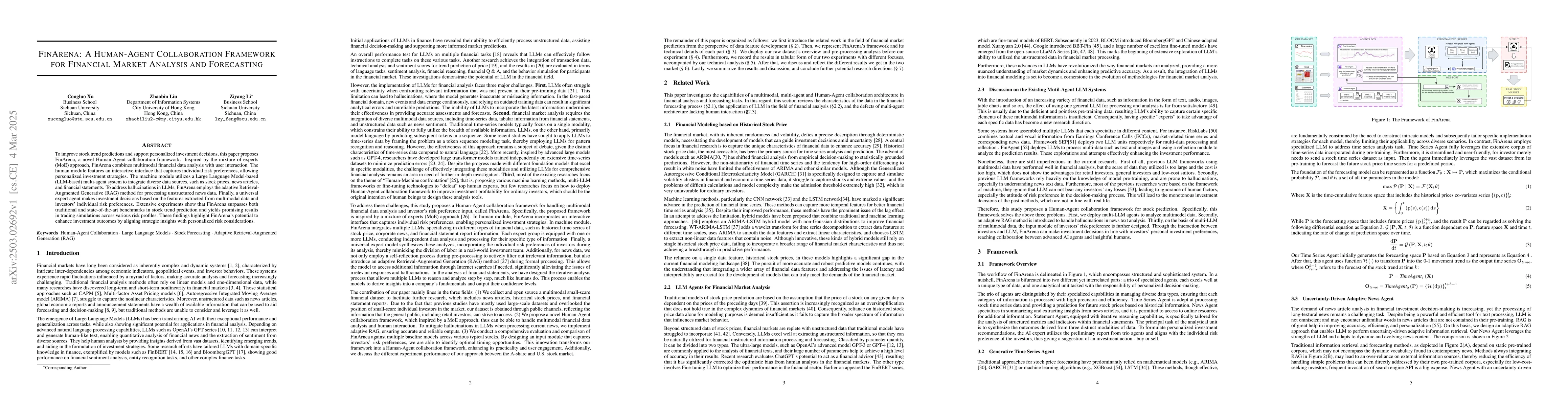

To improve stock trend predictions and support personalized investment decisions, this paper proposes FinArena, a novel Human-Agent collaboration framework. Inspired by the mixture of experts (MoE) approach, FinArena combines multimodal financial data analysis with user interaction. The human module features an interactive interface that captures individual risk preferences, allowing personalized investment strategies. The machine module utilizes a Large Language Model-based (LLM-based) multi-agent system to integrate diverse data sources, such as stock prices, news articles, and financial statements. To address hallucinations in LLMs, FinArena employs the adaptive Retrieval-Augmented Generative (RAG) method for processing unstructured news data. Finally, a universal expert agent makes investment decisions based on the features extracted from multimodal data and investors' individual risk preferences. Extensive experiments show that FinArena surpasses both traditional and state-of-the-art benchmarks in stock trend prediction and yields promising results in trading simulations across various risk profiles. These findings highlight FinArena's potential to enhance investment outcomes by aligning strategic insights with personalized risk considerations.

AI Key Findings

Generated Jun 10, 2025

Methodology

FinArena, a Human-Agent Collaboration Framework, integrates multimodal financial data analysis with user interaction, combining a Large Language Model-based multi-agent system and an interactive interface for personalized investment strategies.

Key Results

- FinArena outperforms traditional and state-of-the-art benchmarks in stock trend prediction.

- The framework yields promising results in trading simulations across various risk profiles.

- The adaptive Retrieval-Augmented Generative (RAG) method effectively reduces hallucinations in LLMs for processing unstructured news data.

- A universal expert agent makes investment decisions based on multimodal data features and individual risk preferences.

Significance

FinArena enhances investment outcomes by aligning strategic insights with personalized risk considerations, potentially benefiting both retail and institutional investors.

Technical Contribution

FinArena introduces an adaptive RAG method to reduce hallucinations in LLMs for financial news data processing, and a universal expert agent for investment decision-making based on multimodal data and personalized risk preferences.

Novelty

FinArena's Human-Agent Collaboration Framework combines the strengths of specialized LLM agents and human expertise, providing a more comprehensive and nuanced approach to complex investment problems compared to existing single-source or traditional machine learning models.

Limitations

- Performance in the A-share market is less consistent compared to the U.S. market, likely due to information disclosure and data quality issues.

- The study did not explore the impact of real-time data or high-frequency trading on FinArena's performance.

Future Work

- Investigate the effectiveness of FinArena with real-time and high-frequency financial data.

- Explore the potential of incorporating alternative data sources, such as social media sentiment or satellite imagery, into the framework.

- Further research into addressing information asymmetry and improving data quality in emerging markets.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Investment Analysis: Optimizing AI-Agent Collaboration in Financial Research

Neng Wang, Kunpeng Zhang, Sean Xin Xu et al.

A K-means Algorithm for Financial Market Risk Forecasting

Yue Wang, Jinxin Xu, Ruisi Li et al.

Cross-Modal Temporal Fusion for Financial Market Forecasting

John Cartlidge, Yunhua Pei, Daniel Gold et al.

No citations found for this paper.

Comments (0)