Authors

Summary

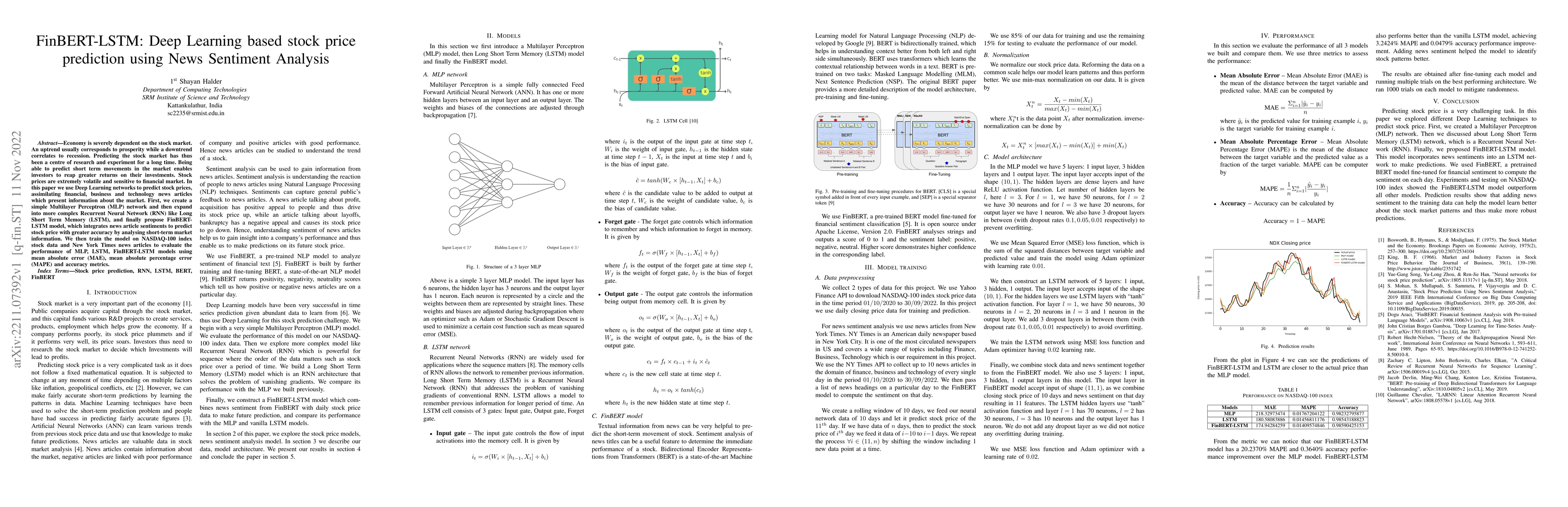

Economy is severely dependent on the stock market. An uptrend usually corresponds to prosperity while a downtrend correlates to recession. Predicting the stock market has thus been a centre of research and experiment for a long time. Being able to predict short term movements in the market enables investors to reap greater returns on their investments. Stock prices are extremely volatile and sensitive to financial market. In this paper we use Deep Learning networks to predict stock prices, assimilating financial, business and technology news articles which present information about the market. First, we create a simple Multilayer Perceptron (MLP) network and then expand into more complex Recurrent Neural Network (RNN) like Long Short Term Memory (LSTM), and finally propose FinBERT-LSTM model, which integrates news article sentiments to predict stock price with greater accuracy by analysing short-term market information. We then train the model on NASDAQ-100 index stock data and New York Times news articles to evaluate the performance of MLP, LSTM, FinBERT-LSTM models using mean absolute error (MAE), mean absolute percentage error (MAPE) and accuracy metrics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPredicting Stock Prices with FinBERT-LSTM: Integrating News Sentiment Analysis

Yihao Zhong, Zhuoyue Wang, Wenjun Gu et al.

Financial sentiment analysis using FinBERT with application in predicting stock movement

Tingsong Jiang, Andy Zeng

Innovative Sentiment Analysis and Prediction of Stock Price Using FinBERT, GPT-4 and Logistic Regression: A Data-Driven Approach

Bayode Ogunleye, Olamilekan Shobayo, Sidikat Adeyemi-Longe et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)