Summary

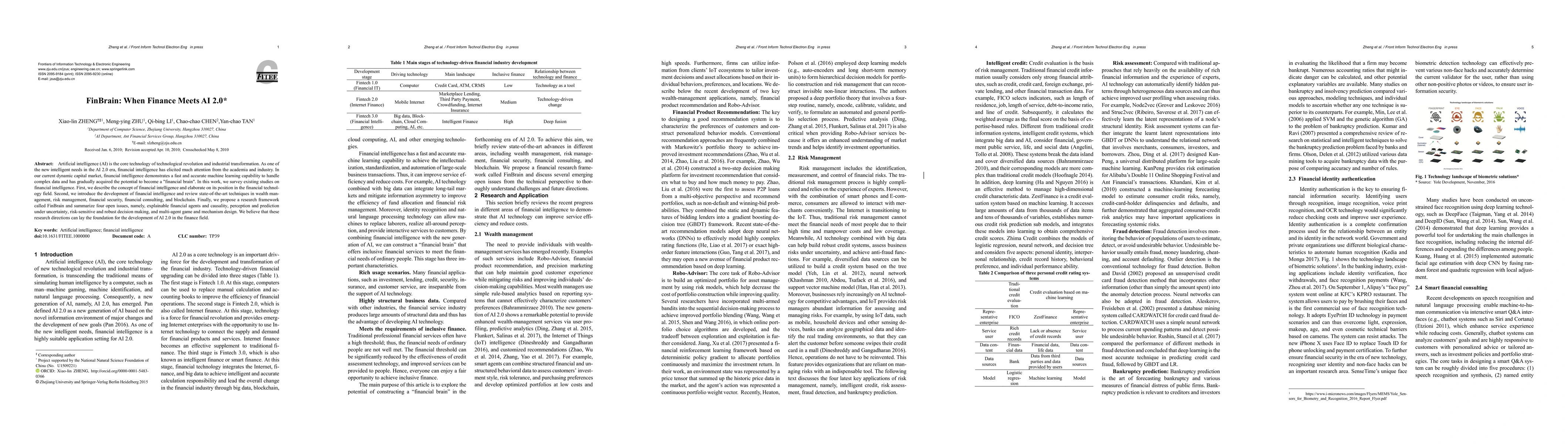

Artificial intelligence (AI) is the core technology of technological revolution and industrial transformation. As one of the new intelligent needs in the AI 2.0 era, financial intelligence has elicited much attention from the academia and industry. In our current dynamic capital market, financial intelligence demonstrates a fast and accurate machine learning capability to handle complex data and has gradually acquired the potential to become a "financial brain". In this work, we survey existing studies on financial intelligence. First, we describe the concept of financial intelligence and elaborate on its position in the financial technology field. Second, we introduce the development of financial intelligence and review state-of-the-art techniques in wealth management, risk management, financial security, financial consulting, and blockchain. Finally, we propose a research framework called FinBrain and summarize four open issues, namely, explainable financial agents and causality, perception and prediction under uncertainty, risk-sensitive and robust decision making, and multi-agent game and mechanism design. We believe that these research directions can lay the foundation for the development of AI 2.0 in the finance field.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhen AI Meets Finance (StockAgent): Large Language Model-based Stock Trading in Simulated Real-world Environments

Chong Zhang, Dong Shu, Mengnan Du et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)