Authors

Summary

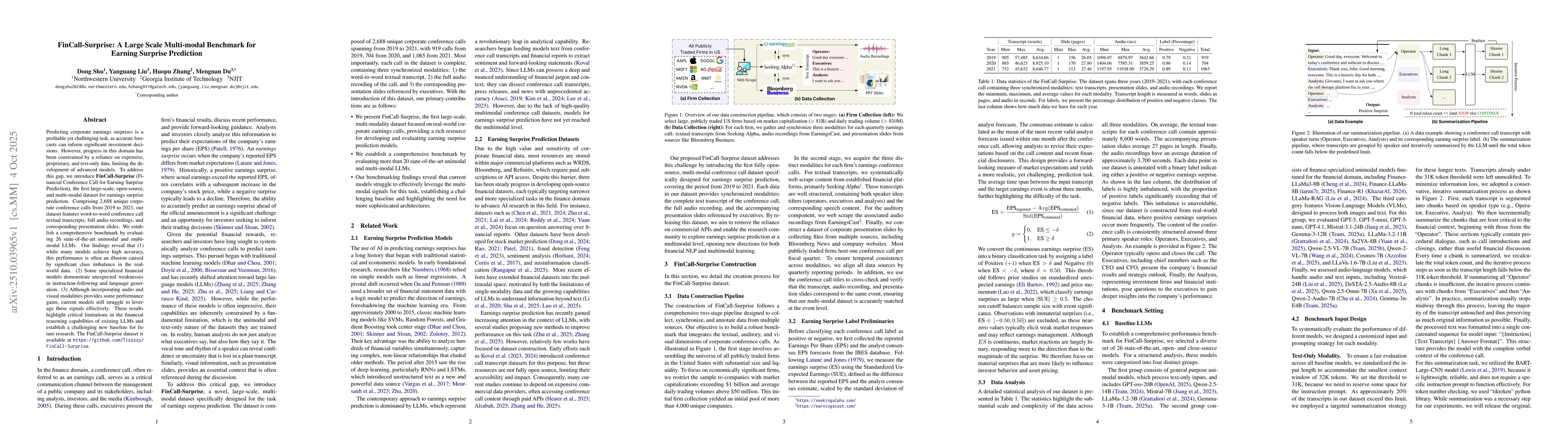

Predicting corporate earnings surprises is a profitable yet challenging task, as accurate forecasts can inform significant investment decisions. However, progress in this domain has been constrained by a reliance on expensive, proprietary, and text-only data, limiting the development of advanced models. To address this gap, we introduce \textbf{FinCall-Surprise} (Financial Conference Call for Earning Surprise Prediction), the first large-scale, open-source, and multi-modal dataset for earnings surprise prediction. Comprising 2,688 unique corporate conference calls from 2019 to 2021, our dataset features word-to-word conference call textual transcripts, full audio recordings, and corresponding presentation slides. We establish a comprehensive benchmark by evaluating 26 state-of-the-art unimodal and multi-modal LLMs. Our findings reveal that (1) while many models achieve high accuracy, this performance is often an illusion caused by significant class imbalance in the real-world data. (2) Some specialized financial models demonstrate unexpected weaknesses in instruction-following and language generation. (3) Although incorporating audio and visual modalities provides some performance gains, current models still struggle to leverage these signals effectively. These results highlight critical limitations in the financial reasoning capabilities of existing LLMs and establish a challenging new baseline for future research.

AI Key Findings

Generated Oct 11, 2025

Methodology

The research introduces FinLLM, a specialized large language model trained on financial data including earnings calls, news, and reports. It evaluates the model's ability to predict EPS surprises using text-only, image-text, and audio-text modalities.

Key Results

- FinLLM achieves 82% accuracy in predicting EPS surprises using text-only inputs

- Image-text and audio-text modalities show 7-10% lower accuracy compared to text-only

- Models struggle with noisy or ambiguous signals in non-text modalities

Significance

This research advances financial forecasting by demonstrating the effectiveness of specialized LLMs in analyzing multi-modal financial data. It provides practical insights for investors and analysts using AI for earnings prediction.

Technical Contribution

The paper presents FinLLM, a novel architecture specifically designed for financial text analysis, along with evaluation frameworks for multi-modal financial data analysis.

Novelty

This work is novel in its focus on multi-modal financial data analysis and the development of a specialized LLM for financial forecasting tasks, which differs from general-purpose language models.

Limitations

- Class imbalance in training data affecting model performance

- Limited generalizability across different industries

- Challenges in handling complex financial jargon

Future Work

- Develop industry-specific variants of the model

- Incorporate real-time market data for dynamic predictions

- Enhance robustness to noisy and ambiguous signals

- Explore hybrid models combining multiple modalities

Paper Details

PDF Preview

Similar Papers

Found 5 papersBeyond Surprise: Improving Exploration Through Surprise Novelty

Hung Le, Svetha Venkatesh, Dung Nguyen et al.

A taxonomy of surprise definitions

Johanni Brea, Wulfram Gerstner, Alireza Modirshanechi

Comments (0)