Authors

Summary

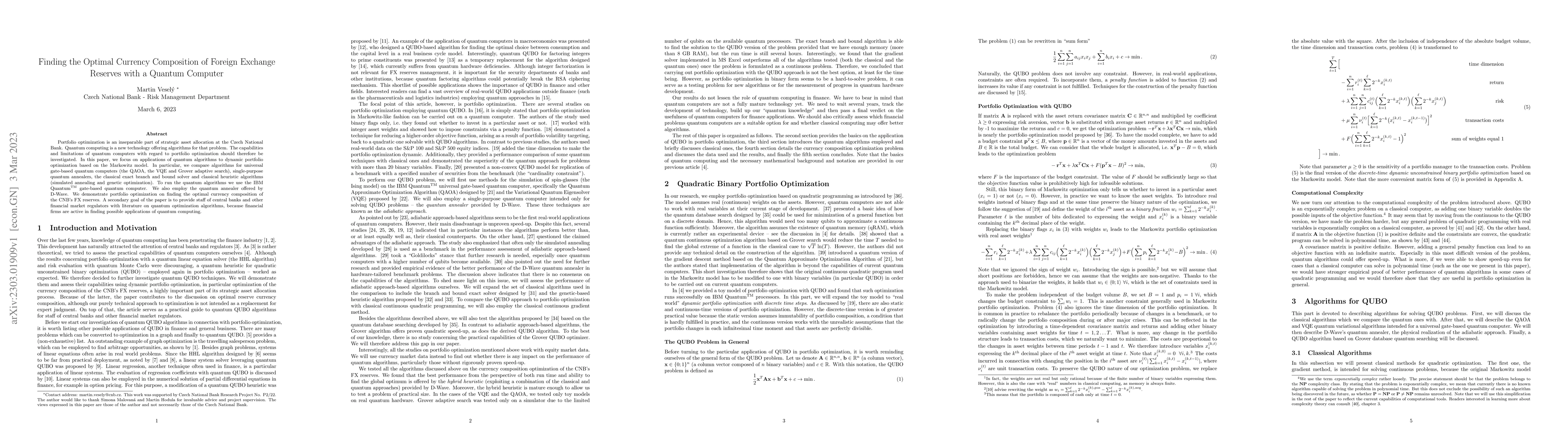

Portfolio optimization is an inseparable part of strategic asset allocation at the Czech National Bank. Quantum computing is a new technology offering algorithms for that problem. The capabilities and limitations of quantum computers with regard to portfolio optimization should therefore be investigated. In this paper, we focus on applications of quantum algorithms to dynamic portfolio optimization based on the Markowitz model. In particular, we compare algorithms for universal gate-based quantum computers (the QAOA, the VQE and Grover adaptive search), single-purpose quantum annealers, the classical exact branch and bound solver and classical heuristic algorithms (simulated annealing and genetic optimization). To run the quantum algorithms we use the IBM Quantum\textsuperscript{TM} gate-based quantum computer. We also employ the quantum annealer offered by D-Wave. We demonstrate portfolio optimization on finding the optimal currency composition of the CNB's FX reserves. A secondary goal of the paper is to provide staff of central banks and other financial market regulators with literature on quantum optimization algorithms, because financial firms are active in finding possible applications of quantum computing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimating the Currency Composition of Foreign Exchange Reserves

Matthew Ferranti

Cutting the Geopolitical Ties: Foreign Exchange Reserves, GDP and Military Spending

Boris Podobnik, Dorian Wild, Dejan Kovac

| Title | Authors | Year | Actions |

|---|

Comments (0)