Summary

Traditional stochastic control methods in finance struggle in real world markets due to their reliance on simplifying assumptions and stylized frameworks. Such methods typically perform well in specific, well defined environments but yield suboptimal results in changed, non stationary ones. We introduce FinFlowRL, a novel framework for financial optimal stochastic control. The framework pretrains an adaptive meta policy learning from multiple expert strategies, then finetunes through reinforcement learning in the noise space to optimize the generative process. By employing action chunking generating action sequences rather than single decisions, it addresses the non Markovian nature of markets. FinFlowRL consistently outperforms individually optimized experts across diverse market conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

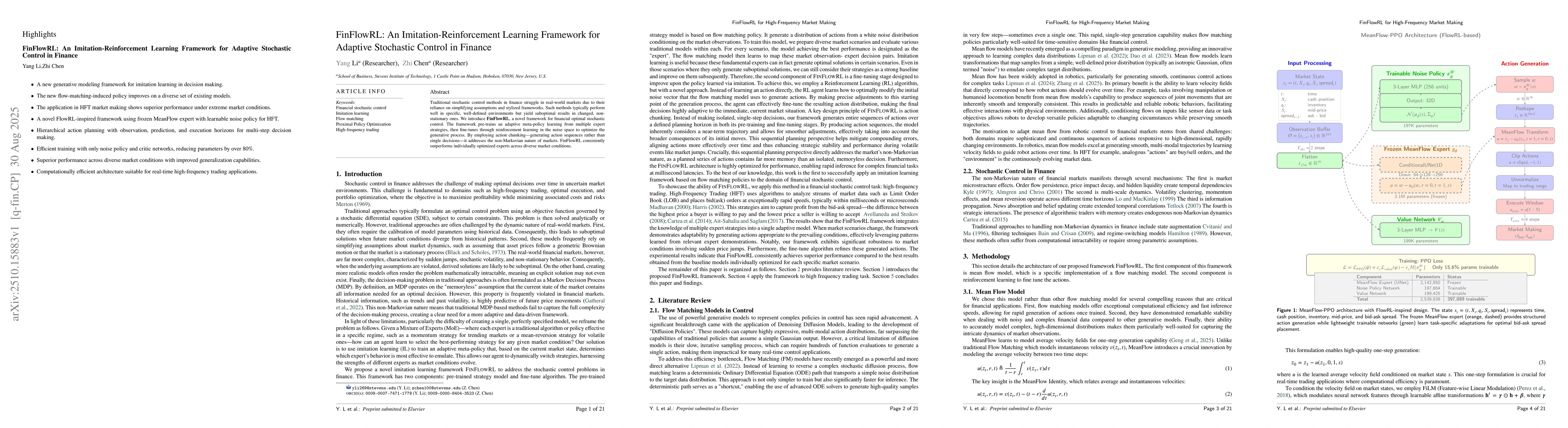

Found 5 papersFinFlowRL: An Imitation-Reinforcement Learning Framework for Adaptive Stochastic Control in Finance

Yang Li, Zhi Chen, Ruixun Zhang et al.

RAIL: A modular framework for Reinforcement-learning-based Adversarial Imitation Learning

Peter Stone, Garrett Warnell, Eddy Hudson

Adaptive PD Control using Deep Reinforcement Learning for Local-Remote Teleoperation with Stochastic Time Delays

Saber Fallah, Luc McCutcheon

Comments (0)