Summary

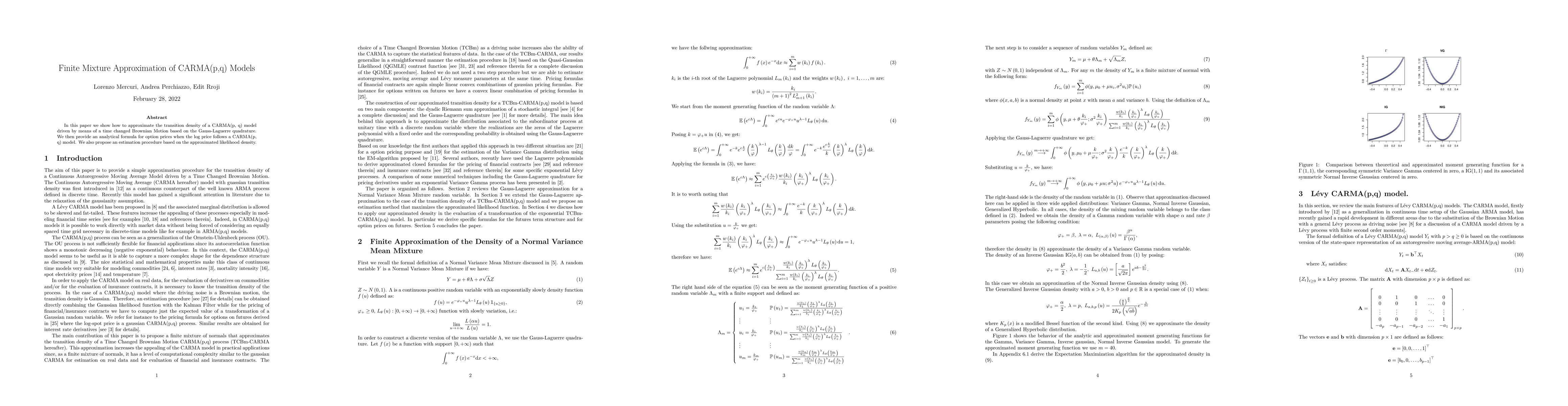

In this paper we show how to approximate the transition density of a CARMA(p, q) model driven by means of a time changed Brownian Motion based on the Gauss-Laguerre quadrature. We then provide an analytical formula for option prices when the log price follows a CARMA(p, q) model. We also propose an estimation procedure based on the approximated likelihood density.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Hawkes model with CARMA(p,q) intensity

Lorenzo Mercuri, Andrea Perchiazzo, Edit Rroji

Option Pricing with a Compound CARMA(p,q)-Hawkes

Lorenzo Mercuri, Andrea Perchiazzo, Edit Rroji

| Title | Authors | Year | Actions |

|---|

Comments (0)