Summary

We investigate the probability that an insurance portfolio gets ruined within a finite time period under the assumption that the r largest claims are (partly) reinsured. We show that for regularly varying claim sizes the probability of ruin after reinsurance is also regularly varying in terms of the initial capital, and derive an explicit asymptotic expression for the latter. We establish this result by leveraging recent developments on sample-path large deviations for heavy tails. Our results allow, on the asymptotic level, for an explicit comparison between two well-known large-claim reinsurance contracts, namely LCR and ECOMOR. We finally assess the accuracy of the resulting approximations using state-of-the-art rare event simulation techniques.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

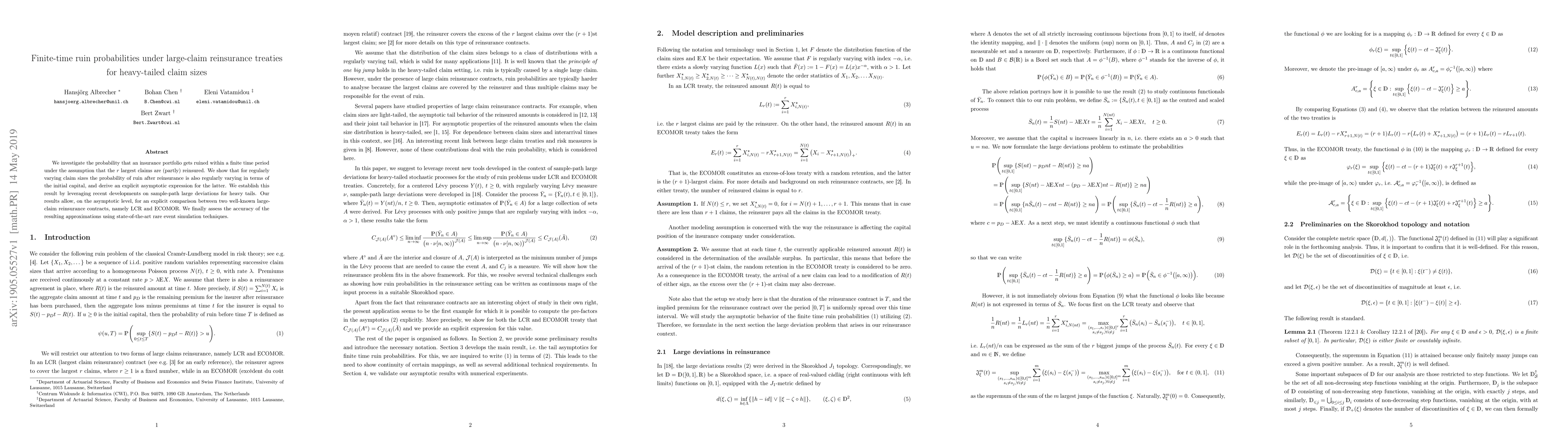

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn the random-time and finite-time ruin probability for widely dependent claim sizes and inter-arrival times

Yang Chen, Zhaolei Cui, Yuebao Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)