Summary

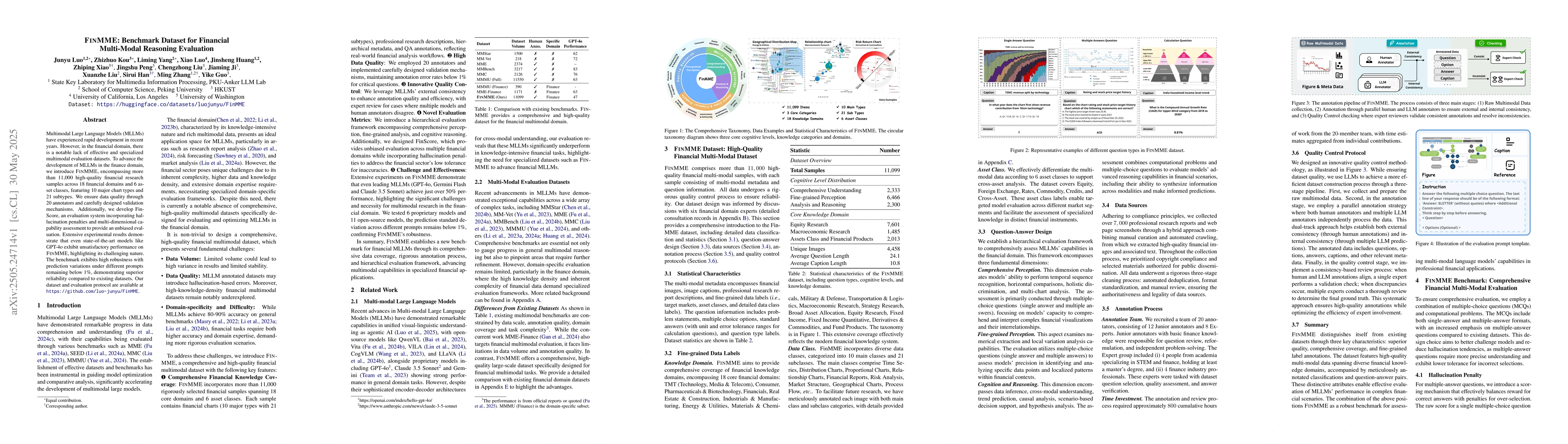

Multimodal Large Language Models (MLLMs) have experienced rapid development in recent years. However, in the financial domain, there is a notable lack of effective and specialized multimodal evaluation datasets. To advance the development of MLLMs in the finance domain, we introduce FinMME, encompassing more than 11,000 high-quality financial research samples across 18 financial domains and 6 asset classes, featuring 10 major chart types and 21 subtypes. We ensure data quality through 20 annotators and carefully designed validation mechanisms. Additionally, we develop FinScore, an evaluation system incorporating hallucination penalties and multi-dimensional capability assessment to provide an unbiased evaluation. Extensive experimental results demonstrate that even state-of-the-art models like GPT-4o exhibit unsatisfactory performance on FinMME, highlighting its challenging nature. The benchmark exhibits high robustness with prediction variations under different prompts remaining below 1%, demonstrating superior reliability compared to existing datasets. Our dataset and evaluation protocol are available at https://huggingface.co/datasets/luojunyu/FinMME and https://github.com/luo-junyu/FinMME.

AI Key Findings

Generated Jun 09, 2025

Methodology

The paper introduces FinMME, a comprehensive multimodal evaluation framework for the financial domain, comprising high-quality samples across 18 core financial domains. It also presents FinScore, an evaluation metric incorporating hallucination penalties and domain-normalized scoring.

Key Results

- Leading MLLMs achieve unsatisfactory performance on FinMME, highlighting significant room for improvement in financial applications.

- FinScore provides a robust evaluation framework for financial tasks, maintaining prediction stability with low standard deviations across different prompts.

- Qwen2.5-VL72B demonstrates competitive performance comparable to proprietary models, excelling in fine-grained perception and single-turn tasks.

- Models perform better in single-turn tasks compared to multi-turn reasoning, with an average performance gap of 20-25%.

- Calculation questions remain the most challenging dimension, with even top models achieving below 40% accuracy.

Significance

This research is important as it addresses the lack of specialized multimodal evaluation datasets in the finance domain, which is crucial for advancing MLLMs in finance. The findings can guide the development of more effective models for financial applications.

Technical Contribution

FinMME and FinScore provide a comprehensive multimodal evaluation framework and metric for financial tasks, incorporating hallucination penalties and domain-normalized scoring.

Novelty

FinMME distinguishes itself by offering high-quality, diverse financial domain samples, addressing the gap in specialized multimodal evaluation datasets for finance, and introducing FinScore for unbiased evaluation.

Limitations

- The evaluation methodology primarily relies on multiple-choice questions and calculations, which may not fully capture the complexity of real-world financial analysis tasks.

- Complex financial concepts pose interpretation difficulties even for knowledgeable annotators, potentially introducing subtle biases despite quality control protocols.

- The dataset does not cover all scenarios encountered in financial work due to the vast and evolving nature of the industry.

- It lacks integration with audio/video content and real-time data analysis.

Future Work

- Expand dataset coverage and enhance evaluation metrics.

- Promote FinMME's application in real-world financial analysis scenarios.

- Address robustness to perturbations, an important research direction building upon FinMME.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFCMR: Robust Evaluation of Financial Cross-Modal Multi-Hop Reasoning

Taeuk Kim, Changhyeon Kim, Seunghee Kim

FinChain: A Symbolic Benchmark for Verifiable Chain-of-Thought Financial Reasoning

Preslav Nakov, Salem Lahlou, Tanmoy Chakraborty et al.

Polymath: A Challenging Multi-modal Mathematical Reasoning Benchmark

Chitta Baral, Mihir Parmar, Swaroop Mishra et al.

InfiMM-Eval: Complex Open-Ended Reasoning Evaluation For Multi-Modal Large Language Models

Yiqi Wang, Xudong Lin, Quanzeng You et al.

No citations found for this paper.

Comments (0)