Summary

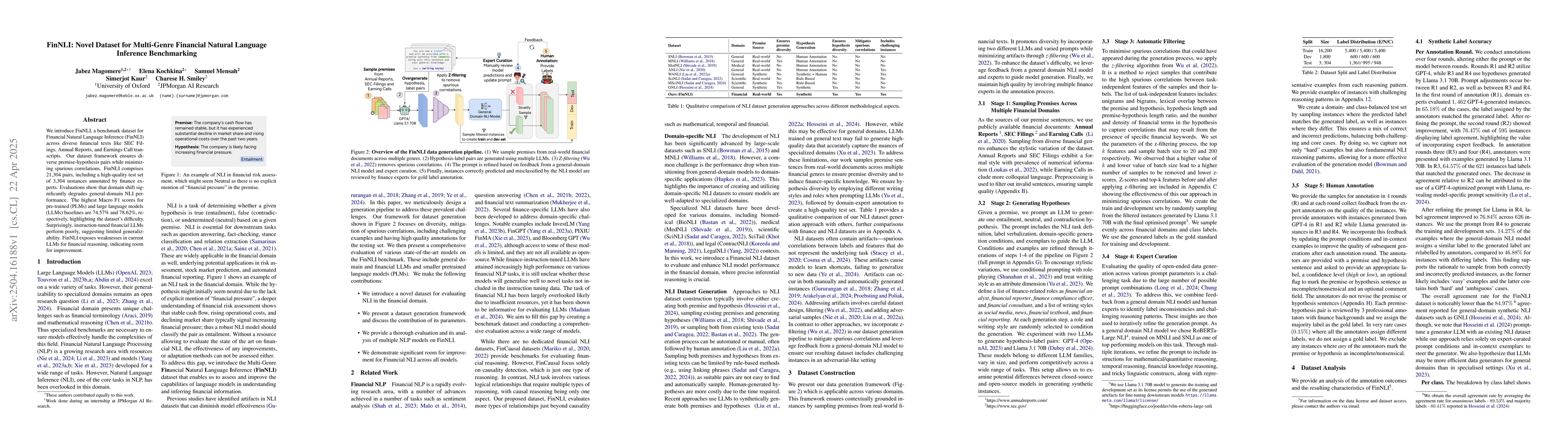

We introduce FinNLI, a benchmark dataset for Financial Natural Language Inference (FinNLI) across diverse financial texts like SEC Filings, Annual Reports, and Earnings Call transcripts. Our dataset framework ensures diverse premise-hypothesis pairs while minimizing spurious correlations. FinNLI comprises 21,304 pairs, including a high-quality test set of 3,304 instances annotated by finance experts. Evaluations show that domain shift significantly degrades general-domain NLI performance. The highest Macro F1 scores for pre-trained (PLMs) and large language models (LLMs) baselines are 74.57% and 78.62%, respectively, highlighting the dataset's difficulty. Surprisingly, instruction-tuned financial LLMs perform poorly, suggesting limited generalizability. FinNLI exposes weaknesses in current LLMs for financial reasoning, indicating room for improvement.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research introduces FinNLI, a benchmark dataset for Financial Natural Language Inference (FinNLI) across diverse financial texts. It ensures diverse premise-hypothesis pairs while minimizing spurious correlations, comprising 21,304 instances with a high-quality test set of 3,304 annotated by finance experts.

Key Results

- FinNLI significantly degrades general-domain NLI performance due to domain shift.

- The highest Macro F1 scores for pre-trained (PLMs) and large language models (LLMs) baselines are 74.57% and 78.62%, respectively.

- Instruction-tuned financial LLMs perform poorly, indicating limited generalizability.

- FinNLI exposes weaknesses in current LLMs for financial reasoning, suggesting room for improvement.

- Zero-shot NLI models are more sensitive to stylistic variations compared to LLMs like Llama3.170B.

Significance

FinNLI fills a significant gap in existing datasets, providing a benchmark for financial reasoning tasks and highlighting the need for improved NLI models in the financial domain.

Technical Contribution

FinNLI offers a novel benchmark dataset for financial NLI, emphasizing the need for domain-specific NLI models and exposing the limitations of current LLMs in financial reasoning.

Novelty

FinNLI is the first NLI dataset specifically focused on the financial domain, providing a benchmark for financial reasoning tasks and filling a significant gap in existing datasets.

Limitations

- The dataset is limited to English, restricting its applicability to non-English financial texts.

- Generated premises may contain fictional information and should not be used to train models that learn factual data.

- The dataset does not account for adversarial settings or more advanced NLI task setups.

Future Work

- Exploration of domain adaptation methods to enhance performance on related tasks.

- Investigation of FinNLI as an intermediate task to improve performance on downstream financial applications.

- Expansion of the dataset to include more languages and non-fictional financial texts.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersESNLIR: A Spanish Multi-Genre Dataset with Causal Relationships

Rubén Manrique, Johan R. Portela, Nicolás Perez

No citations found for this paper.

Comments (0)