Summary

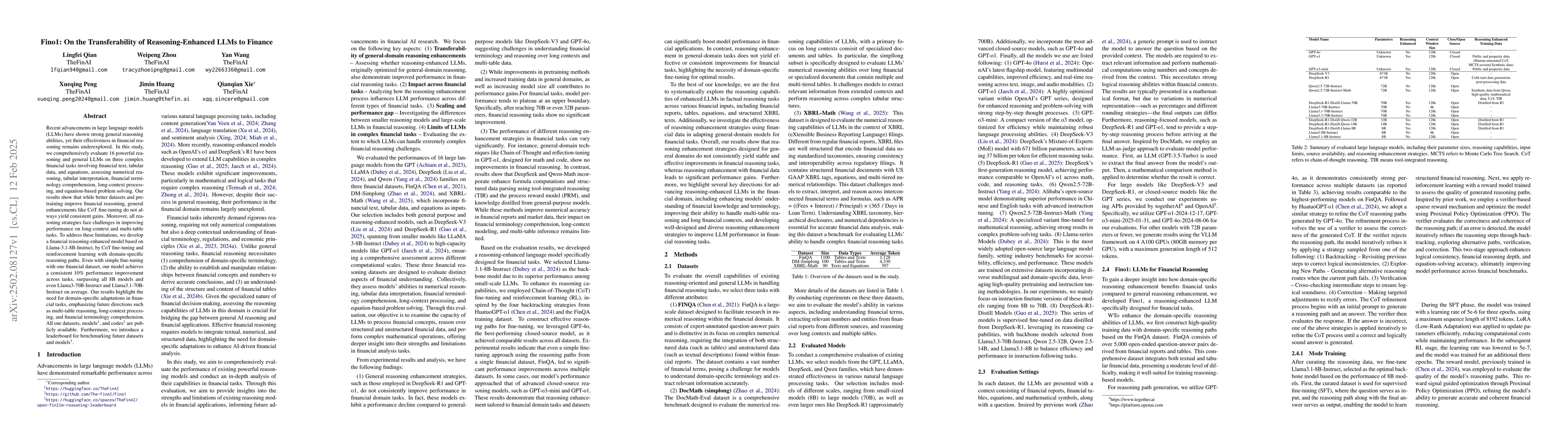

Recent advancements in large language models (LLMs) have shown strong general reasoning abilities, yet their effectiveness in financial reasoning remains underexplored. In this study, we comprehensively evaluate 16 powerful reasoning and general LLMs on three complex financial tasks involving financial text, tabular data, and equations, assessing numerical reasoning, tabular interpretation, financial terminology comprehension, long-context processing, and equation-based problem solving. Our results show that while better datasets and pretraining improve financial reasoning, general enhancements like CoT fine-tuning do not always yield consistent gains. Moreover, all reasoning strategies face challenges in improving performance on long-context and multi-table tasks. To address these limitations, we develop a financial reasoning-enhanced model based on Llama-3.1-8B-Instruct, by CoT fine-tuning and reinforcement learning with domain-specific reasoning paths. Even with simple fine-tuning with one financial dataset, our model achieves a consistent 10% performance improvement across tasks, surpassing all 8B models and even Llama3-70B-Instruct and Llama3.1-70B-Instruct on average. Our results highlight the need for domain-specific adaptations in financial tasks, emphasizing future directions such as multi-table reasoning, long-context processing, and financial terminology comprehension. All our datasets, models, and codes are publicly available. Furthermore, we introduce a leaderboard for benchmarking future datasets and models.

AI Key Findings

Generated Jun 11, 2025

Methodology

The study comprehensively evaluates 16 powerful reasoning and general LLMs on three complex financial tasks involving financial text, tabular data, and equations, assessing numerical reasoning, tabular interpretation, financial terminology comprehension, long-context processing, and equation-based problem solving.

Key Results

- Better datasets and pretraining improve financial reasoning.

- General enhancements like CoT fine-tuning do not always yield consistent gains.

- All reasoning strategies face challenges in improving performance on long-context and multi-table tasks.

- A financial reasoning-enhanced model based on Llama-3.1-8B-Instruct, fine-tuned with CoT and reinforcement learning, achieves a 10% performance improvement across tasks.

- Surpasses all 8B models and even Llama3-70B-Instruct and Llama3.1-70B-Instruct on average.

Significance

Highlights the need for domain-specific adaptations in financial tasks, emphasizing future directions such as multi-table reasoning, long-context processing, and financial terminology comprehension.

Technical Contribution

Development of Fino1, a financial reasoning-enhanced model based on Llama-3.1-8B-Instruct, fine-tuned with CoT and reinforcement learning, demonstrating improved performance on financial tasks.

Novelty

Unlike previous models that struggle with long contexts and multi-table correlations, Fino1 shows significant improvements across all financial tasks, highlighting the effectiveness of high-quality reasoning paths and structured training strategies.

Limitations

- Model scale is limited, with only an 8B model (Fino1) fine-tuned, while larger models could potentially benefit more from reasoning enhancements.

- Evaluation scope is restricted, covering only three financial reasoning tasks which do not fully capture the breadth of financial NLP applications.

Future Work

- Explore the effectiveness of larger models (e.g., 70B) for financial reasoning.

- Expand evaluation to include a wider range of financial NLP applications such as forecasting, sentiment analysis, and fraud detection.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExcessive Reasoning Attack on Reasoning LLMs

Yang Zhang, Mingjie Li, Michael Backes et al.

CER: Confidence Enhanced Reasoning in LLMs

Mahdieh Soleymani Baghshah, Ali Razghandi, Seyed Mohammad Hadi Hosseini

Reasoning Robustness of LLMs to Adversarial Typographical Errors

Michael Shieh, Anirudh Goyal, Yiran Zhao et al.

OverThink: Slowdown Attacks on Reasoning LLMs

Marzena Karpinska, Abhinav Kumar, Mohit Iyyer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)