Summary

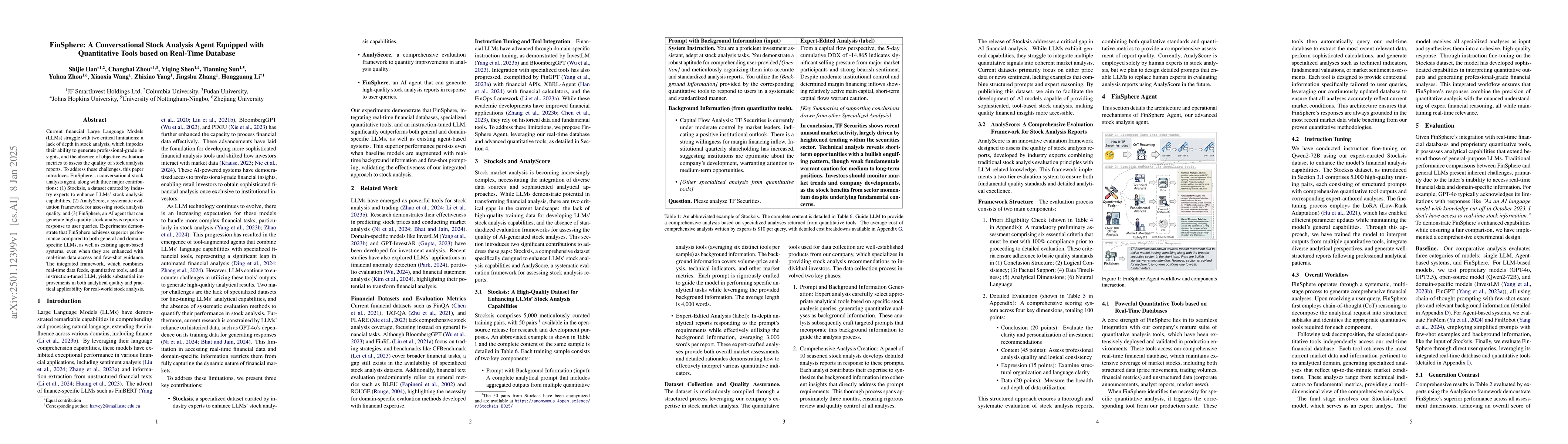

Current financial Large Language Models (LLMs) struggle with two critical limitations: a lack of depth in stock analysis, which impedes their ability to generate professional-grade insights, and the absence of objective evaluation metrics to assess the quality of stock analysis reports. To address these challenges, this paper introduces FinSphere, a conversational stock analysis agent, along with three major contributions: (1) Stocksis, a dataset curated by industry experts to enhance LLMs' stock analysis capabilities, (2) AnalyScore, a systematic evaluation framework for assessing stock analysis quality, and (3) FinSphere, an AI agent that can generate high-quality stock analysis reports in response to user queries. Experiments demonstrate that FinSphere achieves superior performance compared to both general and domain-specific LLMs, as well as existing agent-based systems, even when they are enhanced with real-time data access and few-shot guidance. The integrated framework, which combines real-time data feeds, quantitative tools, and an instruction-tuned LLM, yields substantial improvements in both analytical quality and practical applicability for real-world stock analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReal-Time Online Stock Forecasting Utilizing Integrated Quantitative and Qualitative Analysis

Sai Akash Bathini, Dagli Cihan

ChatNekoHacker: Real-Time Fan Engagement with Conversational Agents

Takuya Sera, Yusuke Hamano

| Title | Authors | Year | Actions |

|---|

Comments (0)