Summary

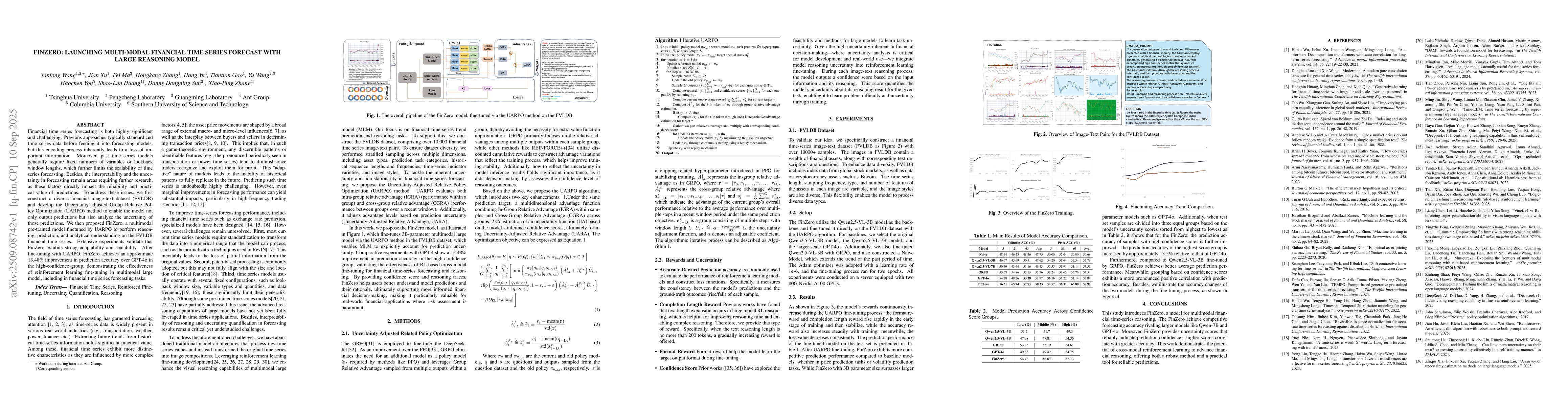

Financial time series forecasting is both highly significant and challenging. Previous approaches typically standardized time series data before feeding it into forecasting models, but this encoding process inherently leads to a loss of important information. Moreover, past time series models generally require fixed numbers of variables or lookback window lengths, which further limits the scalability of time series forecasting. Besides, the interpretability and the uncertainty in forecasting remain areas requiring further research, as these factors directly impact the reliability and practical value of predictions. To address these issues, we first construct a diverse financial image-text dataset (FVLDB) and develop the Uncertainty-adjusted Group Relative Policy Optimization (UARPO) method to enable the model not only output predictions but also analyze the uncertainty of those predictions. We then proposed FinZero, a multimodal pre-trained model finetuned by UARPO to perform reasoning, prediction, and analytical understanding on the FVLDB financial time series. Extensive experiments validate that FinZero exhibits strong adaptability and scalability. After fine-tuning with UARPO, FinZero achieves an approximate 13.48\% improvement in prediction accuracy over GPT-4o in the high-confidence group, demonstrating the effectiveness of reinforcement learning fine-tuning in multimodal large model, including in financial time series forecasting tasks.

AI Key Findings

Generated Nov 02, 2025

Methodology

The paper introduces FinZero, a multimodal pre-trained model fine-tuned using the Uncertainty-adjusted Group Relative Policy Optimization (UARPO) method on the FVLDB dataset. The model is designed for financial time series forecasting, incorporating reasoning, prediction, and analytical understanding.

Key Results

- FinZero achieves a 13.48% improvement in prediction accuracy over GPT-4o in the high-confidence group.

- FinZero demonstrates strong adaptability and scalability in financial time series forecasting.

- The model provides confidence scores and reasoning traces to enhance interpretability and uncertainty analysis.

Significance

This research advances financial forecasting by integrating multimodal reasoning with reinforcement learning, offering more reliable predictions and better uncertainty quantification for financial decision-making.

Technical Contribution

Development of the UARPO method that combines intra-group and cross-group relative advantages with uncertainty adjustment for reinforcement learning fine-tuning.

Novelty

FinZero is the first multimodal model that integrates uncertainty-aware reinforcement learning for financial time series forecasting, combining reasoning, prediction, and uncertainty analysis in a unified framework.

Limitations

- The model's performance may be limited by the quality and diversity of the FVLDB dataset.

- The reinforcement learning fine-tuning process could be computationally intensive.

Future Work

- Exploring the application of FinZero in real-time financial markets.

- Enhancing the model's ability to handle more complex financial instruments and market conditions.

Paper Details

PDF Preview

Similar Papers

Found 4 papersMulti-Modal Financial Time-Series Retrieval Through Latent Space Projections

Manuela Veloso, Tucker Balch, Sriram Gopalakrishnan et al.

Towards Time Series Reasoning with LLMs

Lauren Gardiner, Maxwell A. Xu, Winnie Chow et al.

FCMR: Robust Evaluation of Financial Cross-Modal Multi-Hop Reasoning

Taeuk Kim, Changhyeon Kim, Seunghee Kim

Financial Fine-tuning a Large Time Series Model

Masanori Hirano, Kentaro Imajo, Xinghong Fu

Comments (0)