Summary

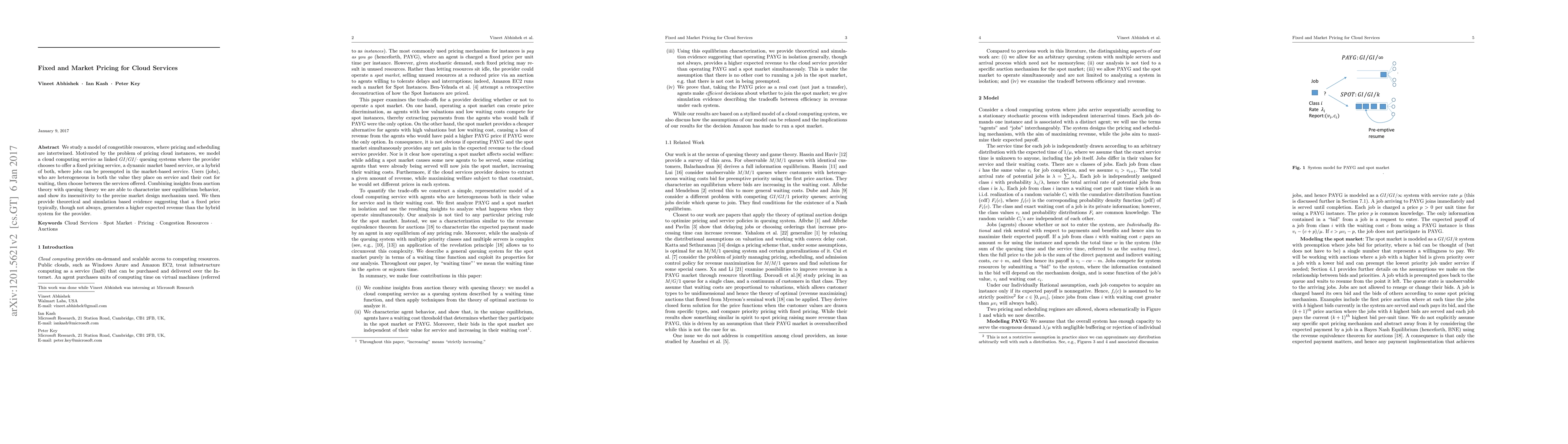

We study a model of congestible resources, where pricing and scheduling are intertwined. Motivated by the problem of pricing cloud instances, we model a cloud computing service as linked $GI/GI/\cdot$ queuing systems where the provider chooses to offer a fixed pricing service, a dynamic market based service, or a hybrid of both, where jobs can be preempted in the market-based service. Users (jobs), who are heterogeneous in both the value they place on service and their cost for waiting, then choose between the services offered. Combining insights from auction theory with queuing theory we are able to characterize user equilibrium behavior, and show its insensitivity to the precise market design mechanism used. We then provide theoretical and simulation based evidence suggesting that a fixed price typically, though not always, generates a higher expected revenue than the hybrid system for the provider.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Pricing of Cloud Services: Committed Spend under Demand Uncertainty

Dirk Bergemann, Michael C. Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)