Summary

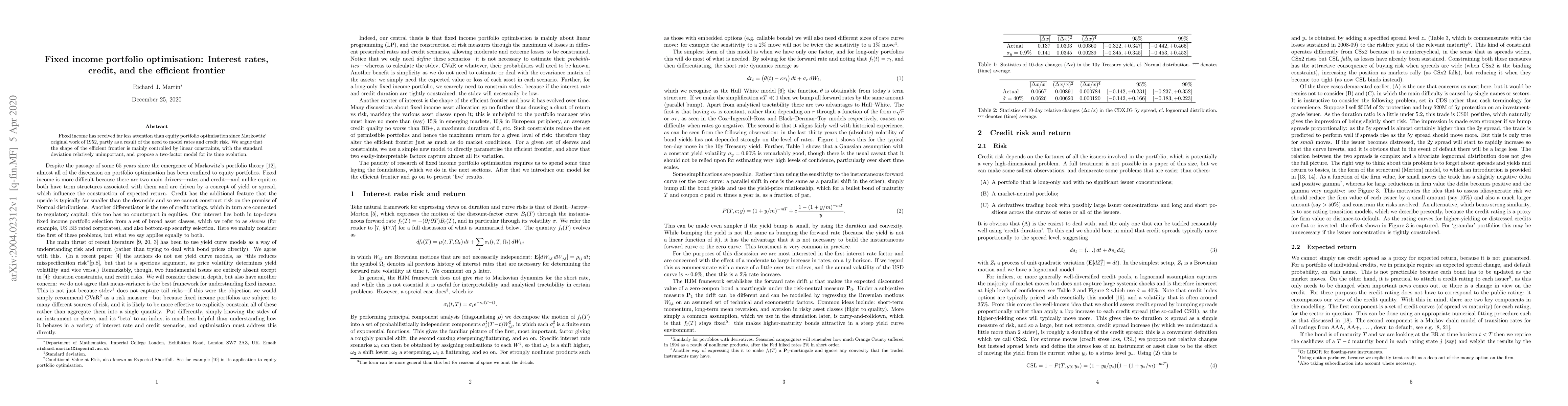

Fixed income has received far less attention than equity portfolio optimisation since Markowitz' original work of 1952, partly as a result of the need to model rates and credit risk. We argue that the shape of the efficient frontier is mainly controlled by linear constraints, with the standard deviation relatively unimportant, and propose a two-factor model for its time evolution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)