Summary

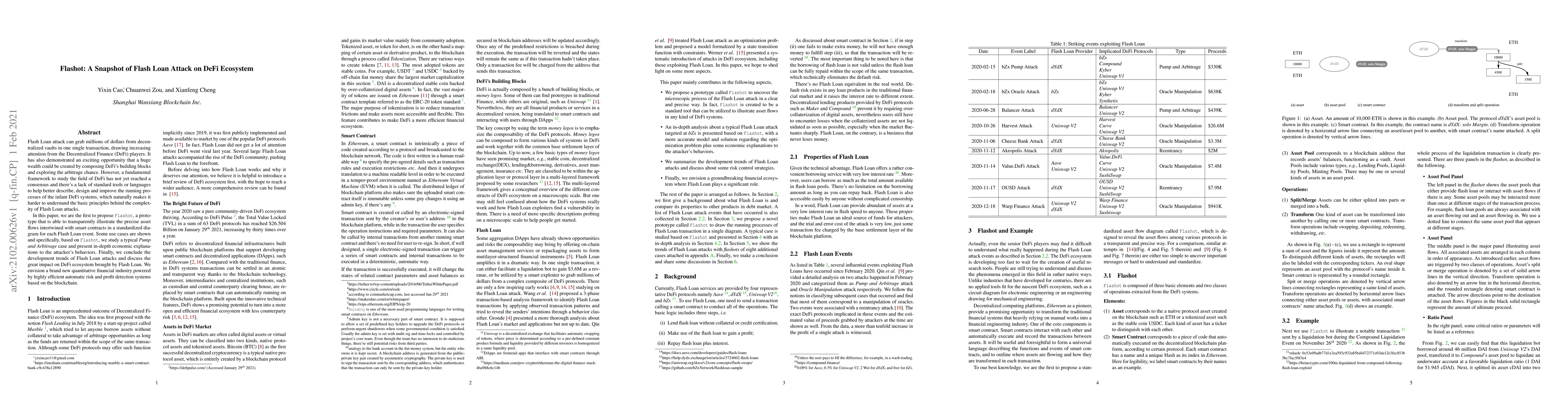

Flash Loan attack can grab millions of dollars from decentralized vaults in one single transaction, drawing increasing attention from the Decentralized Finance (DeFi) players. It has also demonstrated an exciting opportunity that a huge wealth could be created by composing DeFi's building blocks and exploring the arbitrage change. However, a fundamental framework to study the field of DeFi has not yet reached a consensus and there's a lack of standard tools or languages to help better describe, design and improve the running processes of the infant DeFi systems, which naturally makes it harder to understand the basic principles behind the complexity of Flash Loan attacks. In this paper, we are the first to propose Flashot, a prototype that is able to transparently illustrate the precise asset flows intertwined with smart contracts in a standardized diagram for each Flash Loan event. Some use cases are shown and specifically, based on Flashot, we study a typical Pump and Arbitrage case and present in-depth economic explanations to the attacker's behaviors. Finally, we conclude the development trends of Flash Loan attacks and discuss the great impact on DeFi ecosystem brought by Flash Loan. We envision a brand new quantitative financial industry powered by highly efficient automatic risk and profit detection systems based on the blockchain.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProtecting DeFi Platforms against Non-Price Flash Loan Attacks

Balaji Palanisamy, Prashant Krishnamurthy, Abdulrahman Alhaidari

FlashSyn: Flash Loan Attack Synthesis via Counter Example Driven Approximation

Zhiyang Chen, Sidi Mohamed Beillahi, Fan Long

| Title | Authors | Year | Actions |

|---|

Comments (0)