Summary

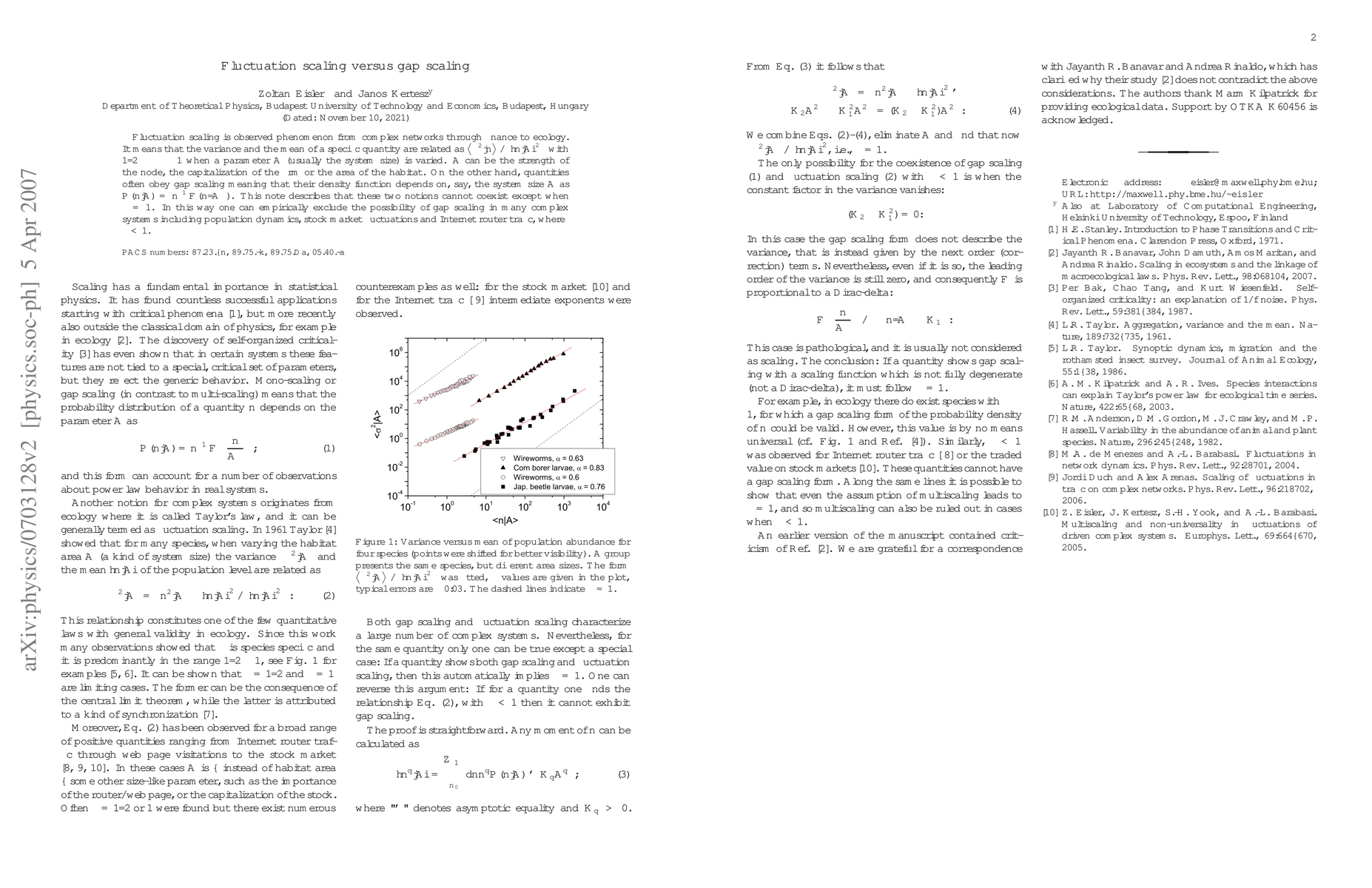

Fluctuation scaling is observed phenomenon from complex networks through finance to ecology. It means that the variance and the mean of a specific quantity are related as $\ev{\sigma^2|n}\propto \ev{n|A}^{2\alpha}$ with $1/2\geq \alpha \geq 1$ when a parameter $A$ (usually the system size) is varied. $A$ can be the strength of the node, the capitalization of the firm or the area of the habitat. On the other hand, quantities often obey gap scaling meaning that their density function depends on, say, the system size $A$ as $P(n|A) = n^{-1}F(n/A^{\Phi})$. This note describes that these two notions cannot coexist except when $\alpha = 1$. In this way one can empirically exclude the possibility of gap scaling in many complex systems including population dynamics, stock market fluctuations and Internet router traffic, where $\alpha < 1$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)