Authors

Summary

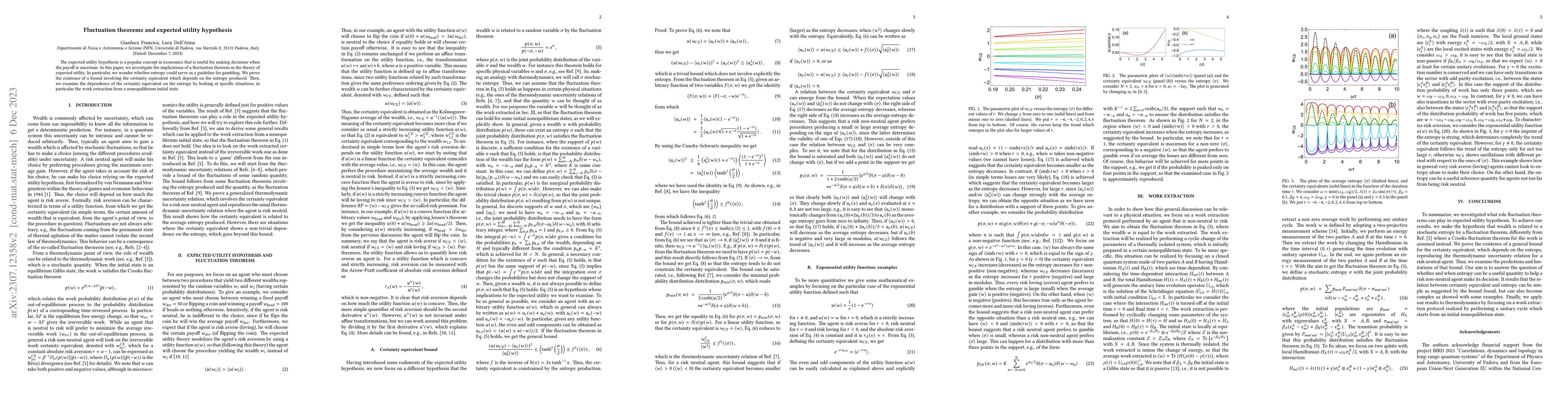

The expected utility hypothesis is a popular concept in economics that is useful for making decisions when the payoff is uncertain. In this paper, we investigate the implications of a fluctuation theorem in the theory of expected utility. In particular, we wonder whether entropy could serve as a guideline for gambling. We prove the existence of a bound involving the certainty equivalent which depends on the entropy produced. Then, we examine the dependence of the certainty equivalent on the entropy by looking at specific situations, in particular the work extraction from a nonequilibrium initial state.

AI Key Findings

Generated Sep 06, 2025

Methodology

A general bound for the certaintyequivalent was derived using a fluctuation theorem, which is related to stochastic entropy.

Key Results

- The bound depends on the entropy and reproduces the thermodynamic uncertainty relation for a risk-neutral agent.

- The relationship between certaintyequivalent and entropy can be simple but also complex under certain conditions.

- The work demonstrates that entropic quantities can be useful references for risk non-neutral agents to make decisions.

Significance

This research contributes to the understanding of expected utility hypothesis by exploring the role of fluctuation theorem in stochastic entropy.

Technical Contribution

A general bound for the certaintyequivalent was derived using a fluctuation theorem, which provides a new perspective on the relationship between stochastic entropy and expected utility.

Novelty

The work presents a novel approach to understanding the role of stochastic entropy in decision-making under uncertainty.

Limitations

- The bound may not hold for all cases or systems.

- The relationship between certaintyequivalent and entropy can be complex and require further investigation.

Future Work

- Further research is needed to explore the applicability of the bound in different systems and scenarios.

- Investigating the conditions under which the relationship between certaintyequivalent and entropy becomes complex is essential.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)