Summary

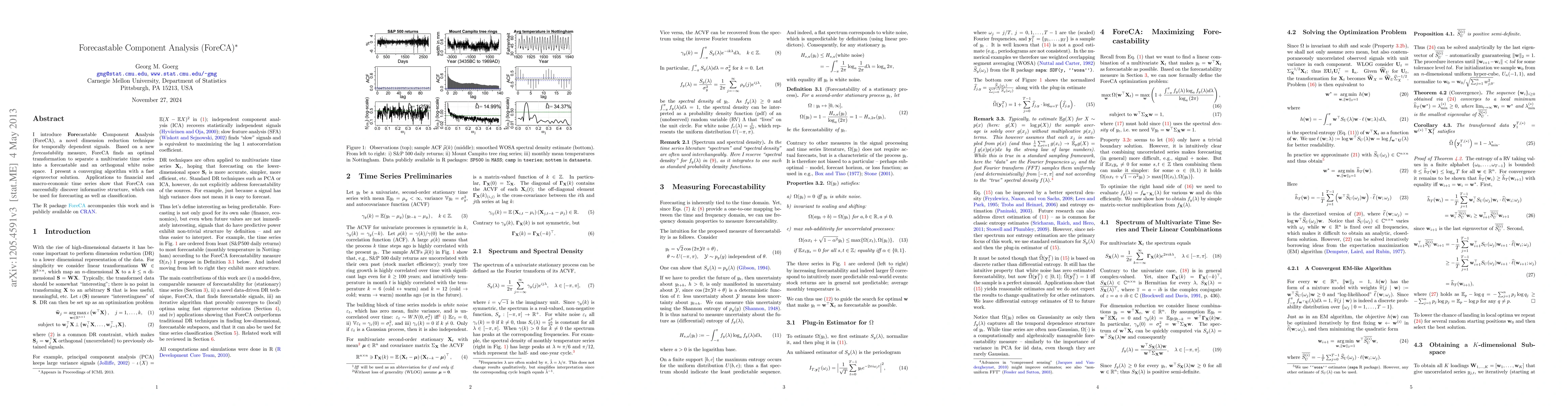

I introduce Forecastable Component Analysis (ForeCA), a novel dimension reduction technique for temporally dependent signals. Based on a new forecastability measure, ForeCA finds an optimal transformation to separate a multivariate time series into a forecastable and an orthogonal white noise space. I present a converging algorithm with a fast eigenvector solution. Applications to financial and macro-economic time series show that ForeCA can successfully discover informative structure, which can be used for forecasting as well as classification. The R package ForeCA (http://cran.r-project.org/web/packages/ForeCA/index.html) accompanies this work and is publicly available on CRAN.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTransferable and Forecastable User Targeting Foundation Model

Yun Zhu, Yun Liu, Yu Cheng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)