Authors

Summary

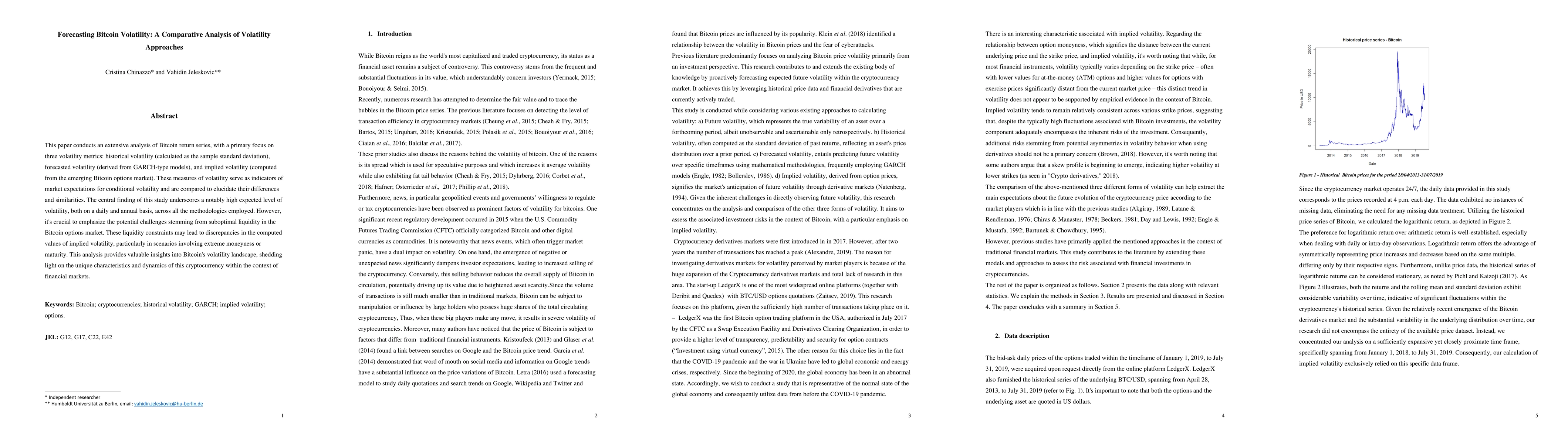

This paper conducts an extensive analysis of Bitcoin return series, with a primary focus on three volatility metrics: historical volatility (calculated as the sample standard deviation), forecasted volatility (derived from GARCH-type models), and implied volatility (computed from the emerging Bitcoin options market). These measures of volatility serve as indicators of market expectations for conditional volatility and are compared to elucidate their differences and similarities. The central finding of this study underscores a notably high expected level of volatility, both on a daily and annual basis, across all the methodologies employed. However, it's crucial to emphasize the potential challenges stemming from suboptimal liquidity in the Bitcoin options market. These liquidity constraints may lead to discrepancies in the computed values of implied volatility, particularly in scenarios involving extreme moneyness or maturity. This analysis provides valuable insights into Bitcoin's volatility landscape, shedding light on the unique characteristics and dynamics of this cryptocurrency within the context of financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)