Authors

Summary

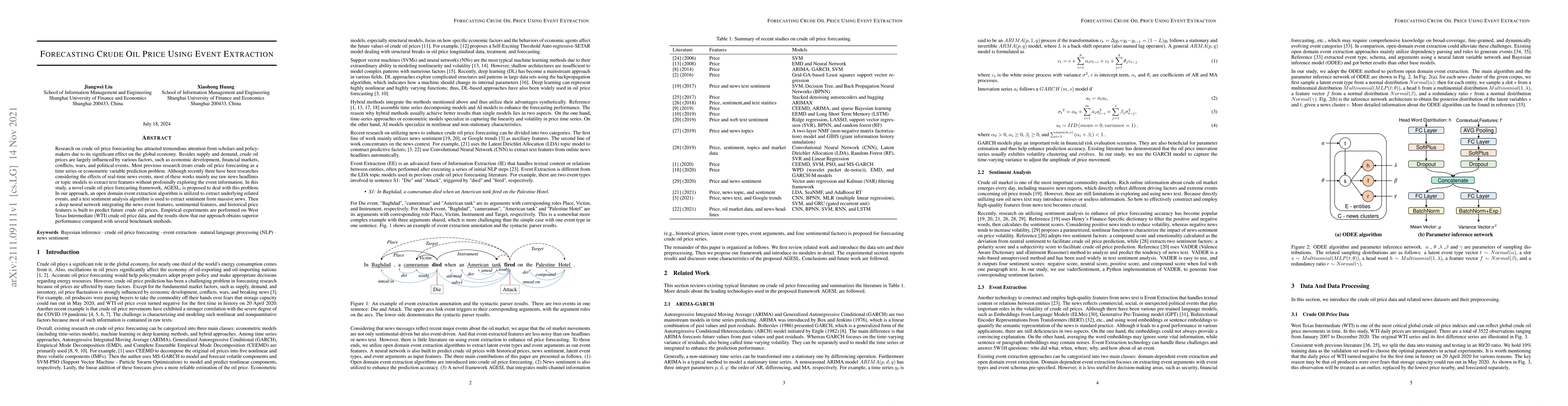

Research on crude oil price forecasting has attracted tremendous attention from scholars and policymakers due to its significant effect on the global economy. Besides supply and demand, crude oil prices are largely influenced by various factors, such as economic development, financial markets, conflicts, wars, and political events. Most previous research treats crude oil price forecasting as a time series or econometric variable prediction problem. Although recently there have been researches considering the effects of real-time news events, most of these works mainly use raw news headlines or topic models to extract text features without profoundly exploring the event information. In this study, a novel crude oil price forecasting framework, AGESL, is proposed to deal with this problem. In our approach, an open domain event extraction algorithm is utilized to extract underlying related events, and a text sentiment analysis algorithm is used to extract sentiment from massive news. Then a deep neural network integrating the news event features, sentimental features, and historical price features is built to predict future crude oil prices. Empirical experiments are performed on West Texas Intermediate (WTI) crude oil price data, and the results show that our approach obtains superior performance compared with several benchmark methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)