Authors

Summary

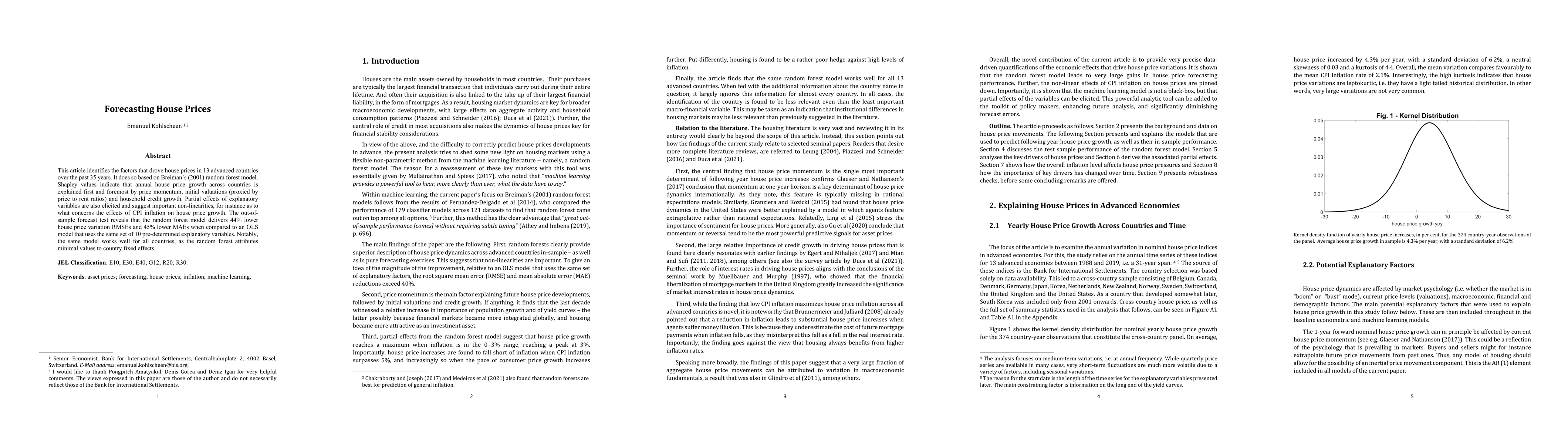

This article identifies the factors that drove house prices in 13 advanced countries over the past 35 years. It does so based on Breiman s (2001) random forest model. Shapley values indicate that annual house price growth across countries is explained first and foremost by price momentum, initial valuations (proxied by price to rent ratios) and household credit growth. Partial effects of explanatory variables are also elicited and suggest important non-linearities, for instance as to what concerns the effects of CPI inflation on house price growth. The out-of-sample forecast test reveals that the random forest model delivers 44% lower house price variation RMSEs and 45% lower MAEs when compared to an OLS model that uses the same set of 10 pre-determined explanatory variables. Notably, the same model works well for all countries, as the random forest attributes minimal values to country fixed effects.

AI Key Findings

Generated Oct 01, 2025

Methodology

The study employs Breiman's (2001) random forest model to analyze house price drivers across 13 advanced countries over 35 years, using Shapley values and partial effects to assess variable importance and non-linear relationships.

Key Results

- Random forest models significantly outperform OLS and AR(1) models, reducing RMSE by 44% and MAE by 45% in out-of-sample forecasts.

- Price momentum, initial valuations (price-to-rent ratios), and household credit growth are the top drivers of house price changes across countries.

- CPI inflation has a non-linear effect on house price growth, peaking at 3% and diminishing beyond that level.

Significance

This research provides robust forecasting tools for policymakers and investors, highlighting key macroeconomic factors influencing housing markets with high predictive accuracy.

Technical Contribution

The paper demonstrates the effectiveness of random forest models in capturing non-linear relationships and improving forecast accuracy in housing markets.

Novelty

It introduces Shapley values and partial effects analysis within a random forest framework to uncover both linear and non-linear impacts on house price dynamics, offering deeper economic interpretation.

Limitations

- The analysis relies on aggregated macroeconomic data without granular household-level details.

- Country-specific mortgage market characteristics are not deeply explored in the study.

Future Work

- Testing the results with more granular country-specific data to improve localized predictions.

- Exploring the role of mortgage market characteristics in housing dynamics across different regions.

Paper Details

PDF Preview

Similar Papers

Found 5 papersExploring Distributions of House Prices and House Price Indices

Jiong Liu, R. A. Serota, Hamed Farahani

Forecasting Electricity Prices

Bartosz Uniejewski, Katarzyna Maciejowska, Rafał Weron

Predicting House Rental Prices in Ghana Using Machine Learning

Philip Adzanoukpe

Comments (0)