Summary

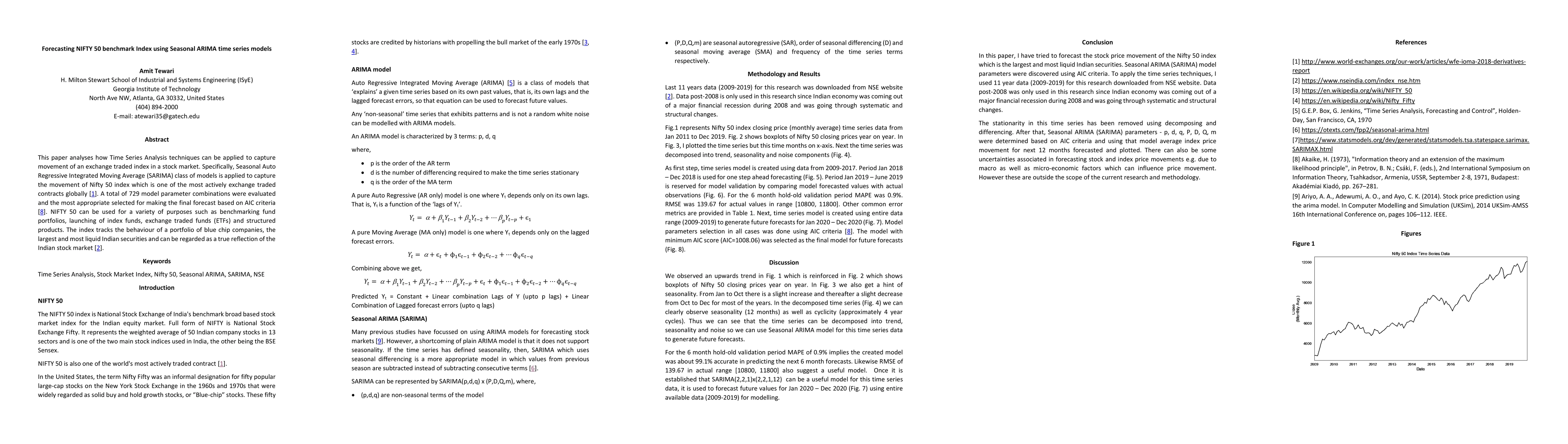

This paper analyses how Time Series Analysis techniques can be applied to capture movement of an exchange traded index in a stock market. Specifically, Seasonal Auto Regressive Integrated Moving Average (SARIMA) class of models is applied to capture the movement of Nifty 50 index which is one of the most actively exchange traded contracts globally [1]. A total of 729 model parameter combinations were evaluated and the most appropriate selected for making the final forecast based on AIC criteria [8]. NIFTY 50 can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, exchange traded funds (ETFs) and structured products. The index tracks the behaviour of a portfolio of blue chip companies, the largest and most liquid Indian securities and can be regarded as a true reflection of the Indian stock market [2].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistributed ARIMA Models for Ultra-long Time Series

Feng Li, Xiaoqian Wang, Yanfei Kang et al.

Empirical Comparison of Lightweight Forecasting Models for Seasonal and Non-Seasonal Time Series

Thanh Son Nguyen, Dang Minh Duc Nguyen, Van Thanh Nguyen

| Title | Authors | Year | Actions |

|---|

Comments (0)