Summary

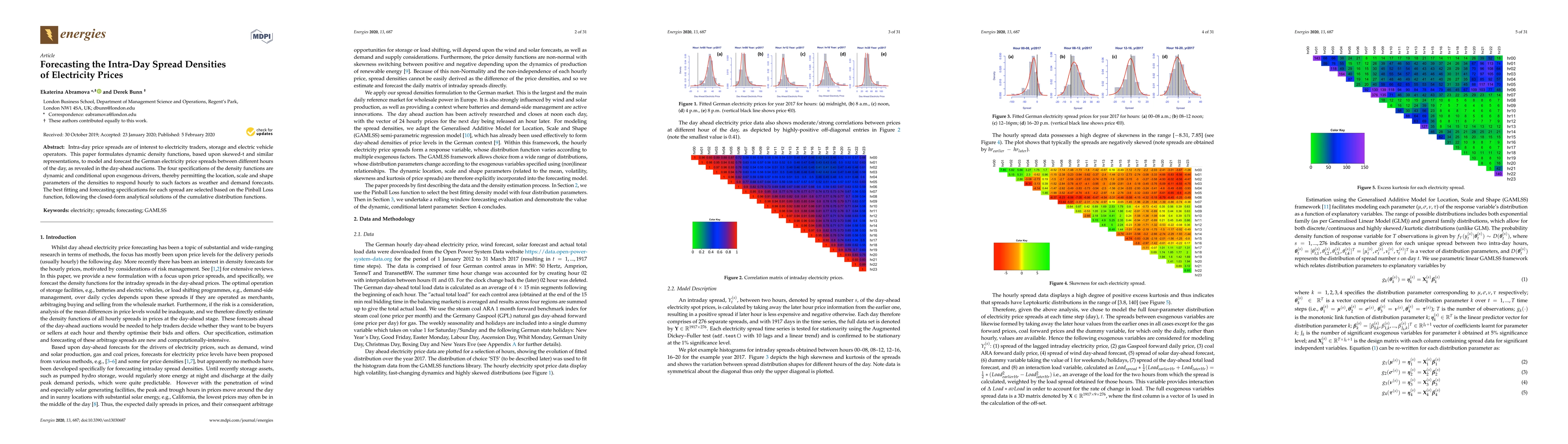

Intra-day price spreads are of interest to electricity traders, storage and electric vehicle operators. This paper formulates dynamic density functions, based upon skewed-t and similar representations, to model and forecast the German electricity price spreads between different hours of the day, as revealed in the day-ahead auctions. The four specifications of the density functions are dynamic and conditional upon exogenous drivers, thereby permitting the location, scale and shape parameters of the densities to respond hourly to such factors as weather and demand forecasts. The best fitting and forecasting specifications for each spread are selected based on the Pinball Loss function, following the closed-form analytical solutions of the cumulative distribution functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic Forecasting of Day-Ahead Electricity Prices and their Volatility with LSTMs

Dirk Witthaut, Leonardo Rydin Gorjão, Benjamin Schäfer et al.

Learning Probability Distributions of Day-Ahead Electricity Prices

Jozef Barunik, Lubos Hanus

| Title | Authors | Year | Actions |

|---|

Comments (0)