Authors

Summary

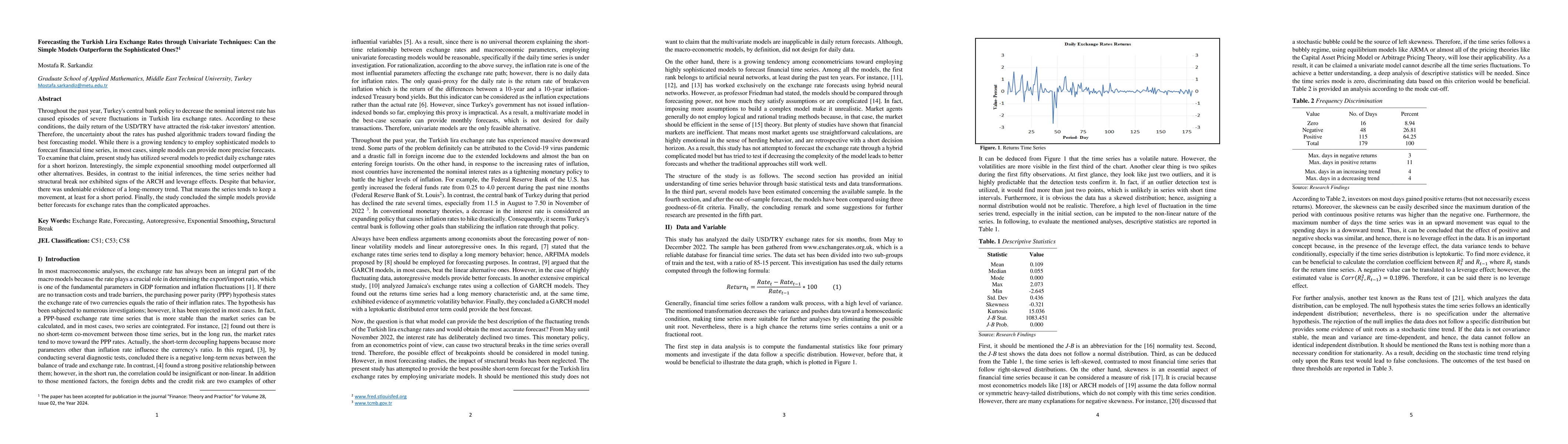

Throughout the past year, Turkey's central bank policy to decrease the nominal interest rate has caused episodes of severe fluctuations in Turkish lira exchange rates. According to these conditions, the daily return of the USD/TRY have attracted the risk-taker investors' attention. Therefore, the uncertainty about the rates has pushed algorithmic traders toward finding the best forecasting model. While there is a growing tendency to employ sophisticated models to forecast financial time series, in most cases, simple models can provide more precise forecasts. To examine that claim, present study has utilized several models to predict daily exchange rates for a short horizon. Interestingly, the simple exponential smoothing model outperformed all other alternatives. Besides, in contrast to the initial inferences, the time series neither had structural break nor exhibited signs of the ARCH and leverage effects. Despite that behavior, there was undeniable evidence of a long-memory trend. That means the series tends to keep a movement, at least for a short period. Finally, the study concluded the simple models provide better forecasts for exchange rates than the complicated approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntraday foreign exchange rate volatility forecasting: univariate and multilevel functional GARCH models

Han Lin Shang, Yuqian Zhao, Fearghal Kearney

Transcendence: Generative Models Can Outperform The Experts That Train Them

Milind Tambe, Naomi Saphra, Eran Malach et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)