Summary

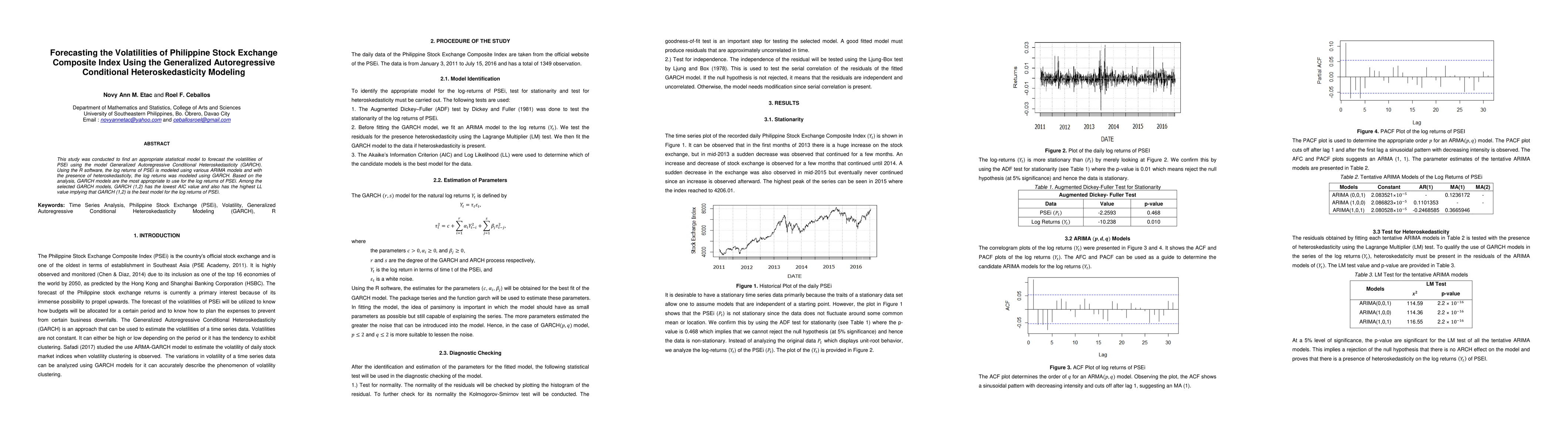

This study was conducted to find an appropriate statistical model to forecast the volatilities of PSEi using the model Generalized Autoregressive Conditional Heteroskedasticity (GARCH). Using the R software, the log returns of PSEi is modeled using various ARIMA models and with the presence of heteroskedasticity, the log returns was modeled using GARCH. Based on the analysis, GARCH models are the most appropriate to use for the log returns of PSEi. Among the selected GARCH models, GARCH (1,2) has the lowest AIC value and also has the highest LL value implying that GARCH (1,2) is the best model for the log returns of PSEi.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)