Summary

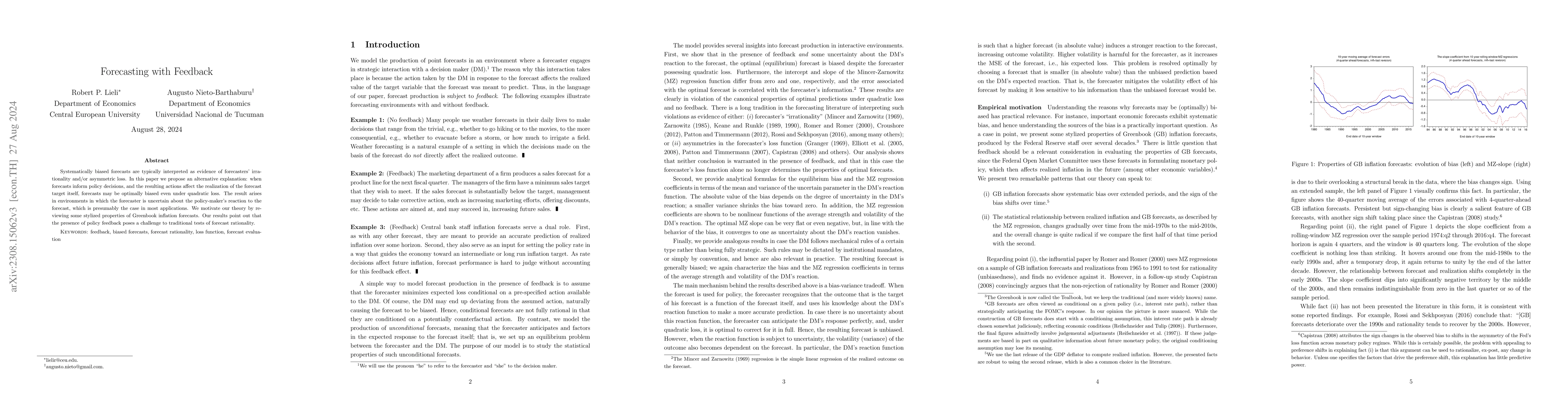

Systematically biased forecasts are typically interpreted as evidence of forecasters' irrationality and/or asymmetric loss. In this paper we propose an alternative explanation: when forecasts inform economic policy decisions, and the resulting actions affect the realization of the forecast target itself, forecasts may be optimally biased even under quadratic loss. The result arises in environments in which the forecaster is uncertain about the decision maker's reaction to the forecast, which is presumably the case in most applications. We illustrate the empirical relevance of our theory by reviewing some stylized properties of Green Book inflation forecasts and relating them to the predictions from our model. Our results point out that the presence of policy feedback poses a challenge to traditional tests of forecast rationality.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFFINet: Future Feedback Interaction Network for Motion Forecasting

Ke Ye, Nanning Zheng, Jingjing Jiang et al.

Error-feedback stochastic modeling strategy for time series forecasting with convolutional neural networks

Kun He, Xinze Zhang, Yukun Bao

| Title | Authors | Year | Actions |

|---|

Comments (0)