Summary

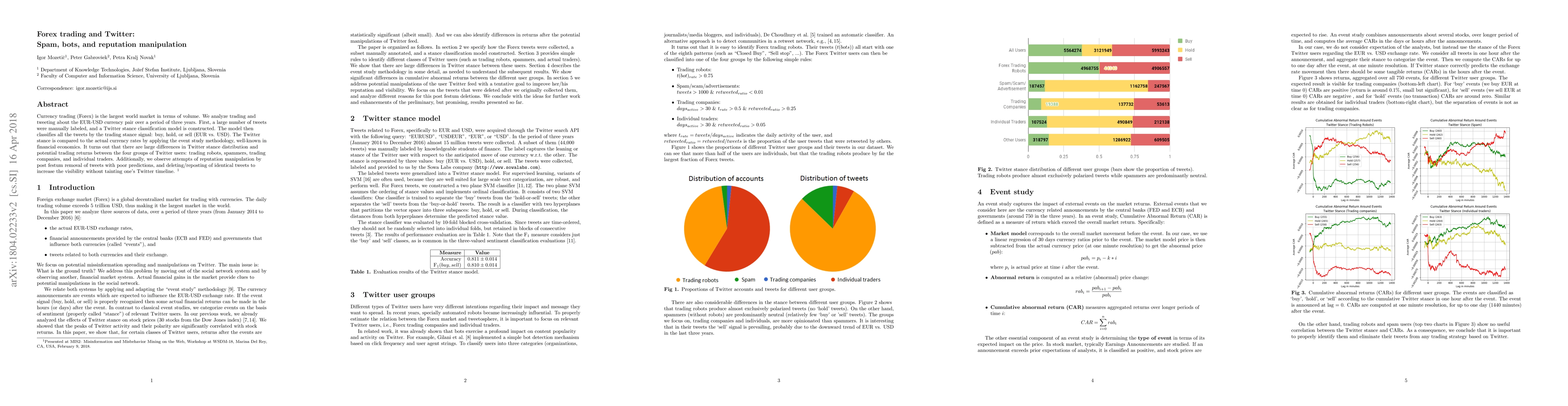

Currency trading (Forex) is the largest world market in terms of volume. We analyze trading and tweeting about the EUR-USD currency pair over a period of three years. First, a large number of tweets were manually labeled, and a Twitter stance classification model is constructed. The model then classifies all the tweets by the trading stance signal: buy, hold, or sell (EUR vs. USD). The Twitter stance is compared to the actual currency rates by applying the event study methodology, well-known in financial economics. It turns out that there are large differences in Twitter stance distribution and potential trading returns between the four groups of Twitter users: trading robots, spammers, trading companies, and individual traders. Additionally, we observe attempts of reputation manipulation by post festum removal of tweets with poor predictions, and deleting/reposting of identical tweets to increase the visibility without tainting one's Twitter timeline.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForex Trading Robot Using Fuzzy Logic

Alireza Nasiri, Mustafa Shabani, Hassan Nafardi

No citations found for this paper.

Comments (0)