Summary

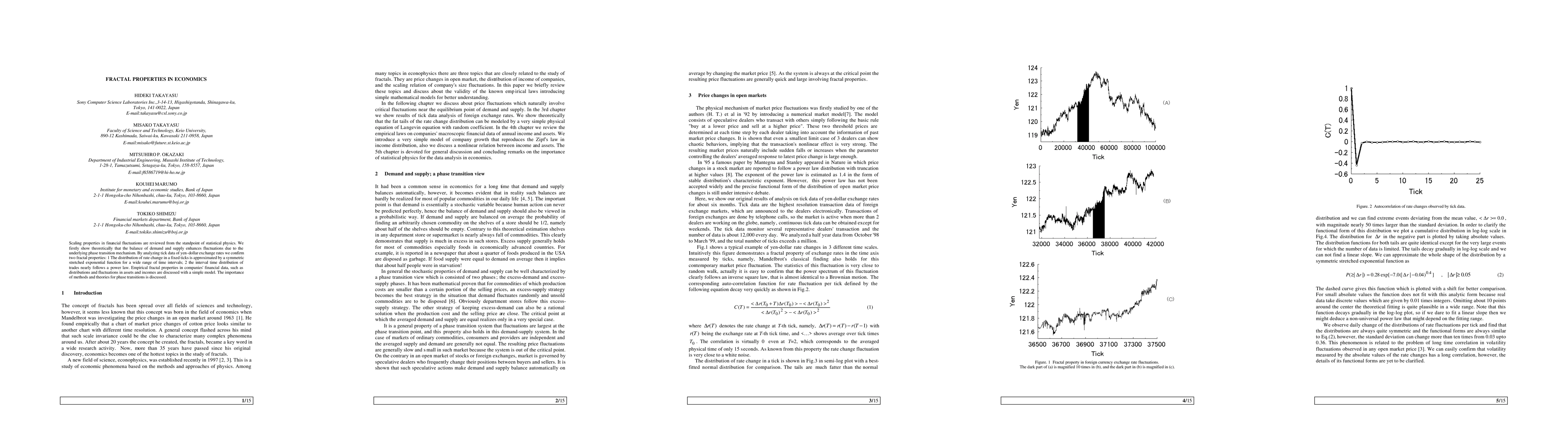

Scaling properties in financial fluctuations are reviewed from the standpoint of statistical physics. We firstly show theoretically that the balance of demand and supply enhances fluctuations due to the underlying phase transition mechanism. By analyzing tick data of yen-dollar exchange rates we confirm two fractal properties: 1 The distribution of rate change in a fixed ticks is approximated by a symmetric stretched exponential function for a wide range of time intervals; 2 the interval time distribution of trades nearly follows a power law. Empirical fractal properties in companies' financial data, such as distributions and fluctuations in assets and incomes are discussed with a simple model. The importance of methods and theories for phase transitions is discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)