Summary

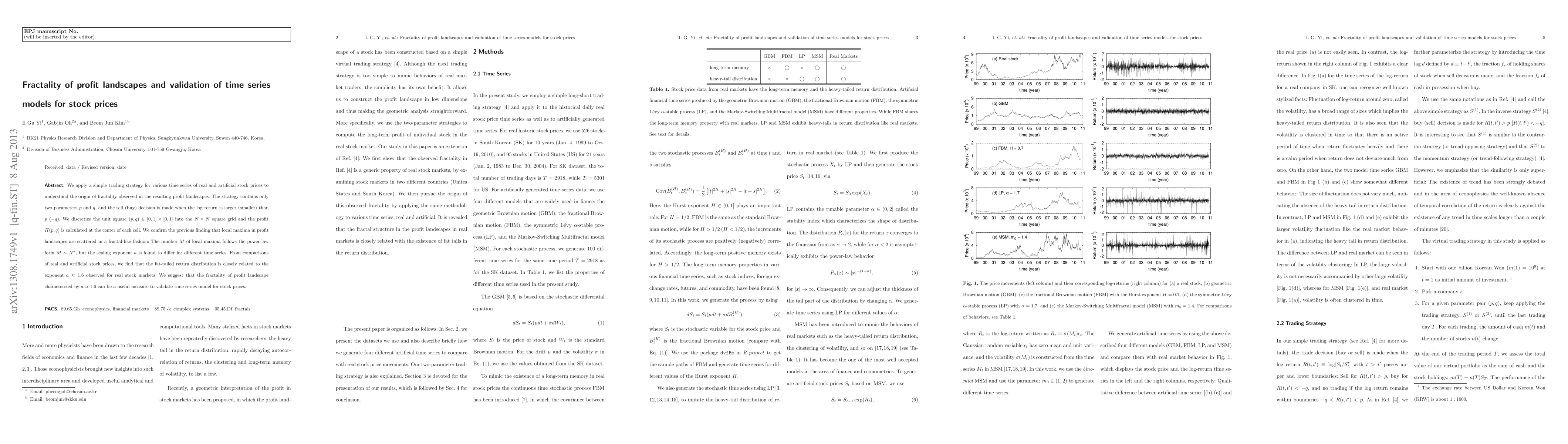

We apply a simple trading strategy for various time series of real and artificial stock prices to understand the origin of fractality observed in the resulting profit landscapes. The strategy contains only two parameters $p$ and $q$, and the sell (buy) decision is made when the log return is larger (smaller) than $p$ ($-q$). We discretize the unit square $(p, q) \in [0, 1] \times [0, 1]$ into the $N \times N$ square grid and the profit $\Pi (p, q)$ is calculated at the center of each cell. We confirm the previous finding that local maxima in profit landscapes are scattered in a fractal-like fashion: The number M of local maxima follows the power-law form $M \sim N^{a}$, but the scaling exponent $a$ is found to differ for different time series. From comparisons of real and artificial stock prices, we find that the fat-tailed return distribution is closely related to the exponent $a \approx 1.6$ observed for real stock markets. We suggest that the fractality of profit landscape characterized by $a \approx 1.6$ can be a useful measure to validate time series model for stock prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)