Authors

Summary

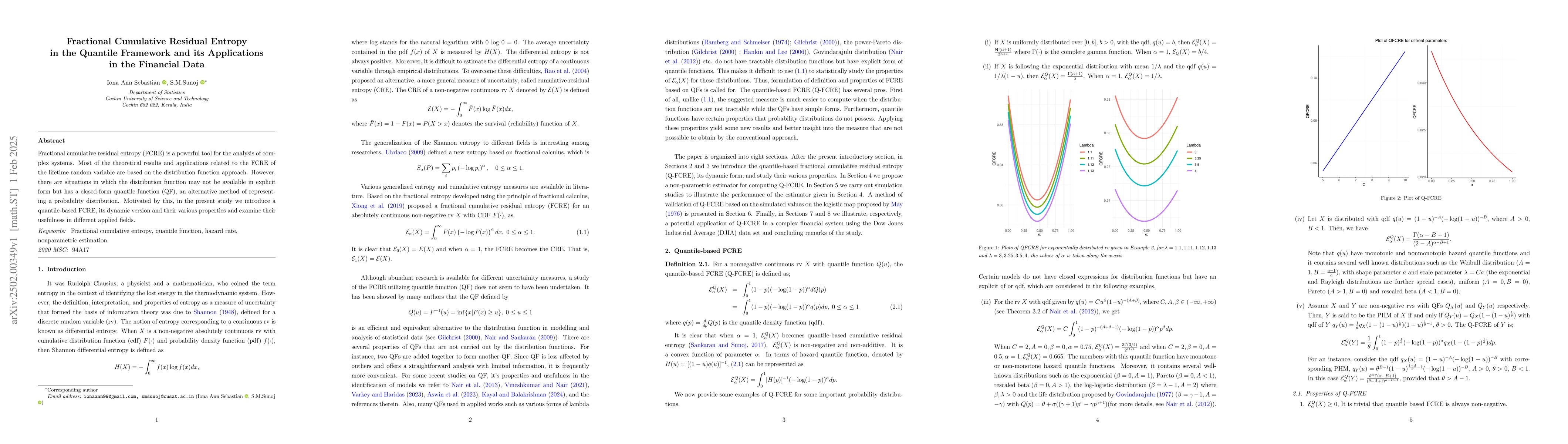

Fractional cumulative residual entropy (FCRE) is a powerful tool for the analysis of complex systems. Most of the theoretical results and applications related to the FCRE of the lifetime random variable are based on the distribution function approach. However, there are situations in which the distribution function may not be available in explicit form but has a closed-form quantile function (QF), an alternative method of representing a probability distribution. Motivated by this, in the present study we introduce a quantile-based FCRE, its dynamic version and their various properties and examine their usefulness in different applied fields.

AI Key Findings

Generated Jun 12, 2025

Methodology

The study introduces a quantile-based fractional cumulative residual entropy (Q-FCRE) and its dynamic version, examining their properties and applications in various fields, including financial data analysis.

Key Results

- A closure property of hazard quantile order between X and Y and the Q-FCRE order is proven.

- Relationships between quantile-based dispersive ordering, reversed hazard quantile ordering, and Q-FCRE are established.

- The Q-FCRE for escort distributions is derived and its properties are discussed.

- The effect of monotonic transformations on quantile-based FCRE is analyzed.

- A nonparametric estimator for Q-FCRE is constructed and its performance is validated through simulation studies.

Significance

This research provides a robust and flexible measure of uncertainty, particularly useful for complex and evolving systems like economic and financial markets, capturing long-term memory, nonstationary behavior, and persistent volatility.

Technical Contribution

The paper presents a quantile-based framework for fractional cumulative residual entropy, extending the applicability of FCRE to situations where explicit distribution functions are unavailable but closed-form quantile functions exist.

Novelty

The novelty of this work lies in its introduction of a quantile-based approach to fractional cumulative residual entropy, providing a more dynamic and flexible measure of uncertainty, especially beneficial for complex systems lacking explicit distribution functions.

Limitations

- The study is limited to theoretical results and does not extensively cover empirical applications beyond the Dow Jones Industrial Average (DJIA) dataset.

- The proposed nonparametric estimator's performance may vary with different datasets and requires further validation across diverse distributions.

Future Work

- Explore applications of Q-FCRE in other fields such as reliability theory, renewal theory, and ecology.

- Investigate the behavior of Q-FCRE under various data-generating processes and distributions.

- Develop more sophisticated estimation techniques to improve accuracy and robustness of Q-FCRE in practical scenarios.

Paper Details

PDF Preview

Similar Papers

Found 4 papersWeighted cumulative residual Entropy Generating Function and its properties

Sudheesh K. Kattumannil, Smitha S., Sreedevi E. P

Dynamic Cumulative Residual Entropy Generating Function and its properties

Smitha S., Sreedevi E. P., Sudheesh K. K.

On the Study of Weighted Fractional Cumulative Residual Inaccuracy and its Dynamical Version with Applications

Aman Pandey, Chanchal Kundu

No citations found for this paper.

Comments (0)