Summary

Along with the recent advances in scalable Markov Chain Monte Carlo methods, sampling techniques that are based on Langevin diffusions have started receiving increasing attention. These so called Langevin Monte Carlo (LMC) methods are based on diffusions driven by a Brownian motion, which gives rise to Gaussian proposal distributions in the resulting algorithms. Even though these approaches have proven successful in many applications, their performance can be limited by the light-tailed nature of the Gaussian proposals. In this study, we extend classical LMC and develop a novel Fractional LMC (FLMC) framework that is based on a family of heavy-tailed distributions, called $\alpha$-stable L\'{e}vy distributions. As opposed to classical approaches, the proposed approach can possess large jumps while targeting the correct distribution, which would be beneficial for efficient exploration of the state space. We develop novel computational methods that can scale up to large-scale problems and we provide formal convergence analysis of the proposed scheme. Our experiments support our theory: FLMC can provide superior performance in multi-modal settings, improved convergence rates, and robustness to algorithm parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

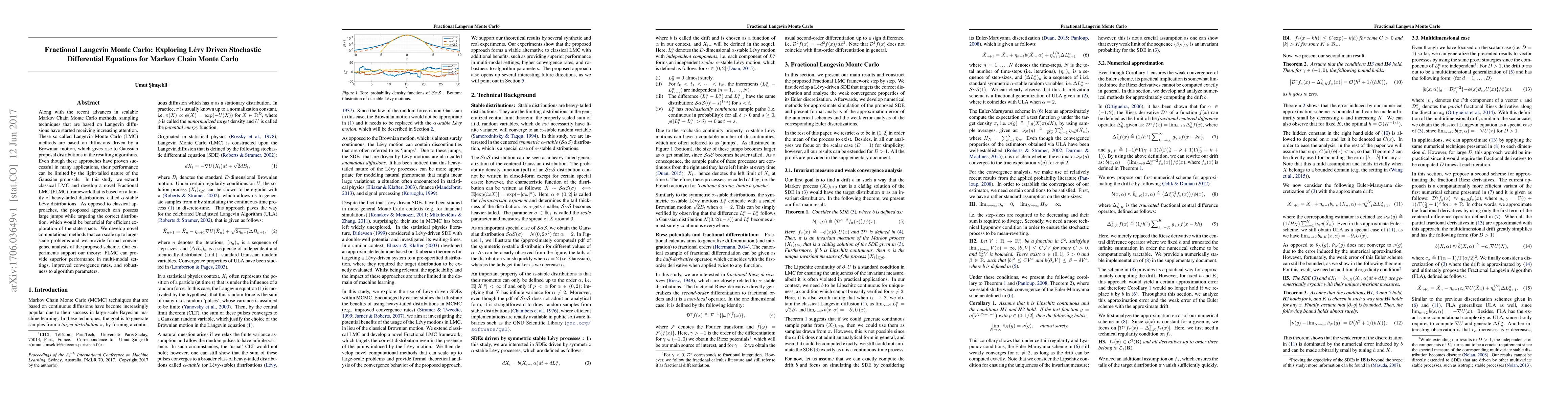

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)