Summary

In this paper, we introduce two new matrix stochastic processes: fractional Wishart processes and $\varepsilon$-fractional Wishart processes with integer indices which are based on the fractional Brownian motions and then extend $\varepsilon$-fractional Wishart processes to the case with non-integer indices. Both of two kinds of processes include classic Wishart processes when the Hurst index $H$ equals $\frac{1}{2}$ and present serial correlation of stochastic processes. Applying $\varepsilon$-fractional Wishart processes to financial volatility theory, the financial models account for the stochastic volatilities of the assets and for the stochastic correlations not only between the underlying assets' returns but also between their volatilities and for stochastic serial correlation of the relevant assets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

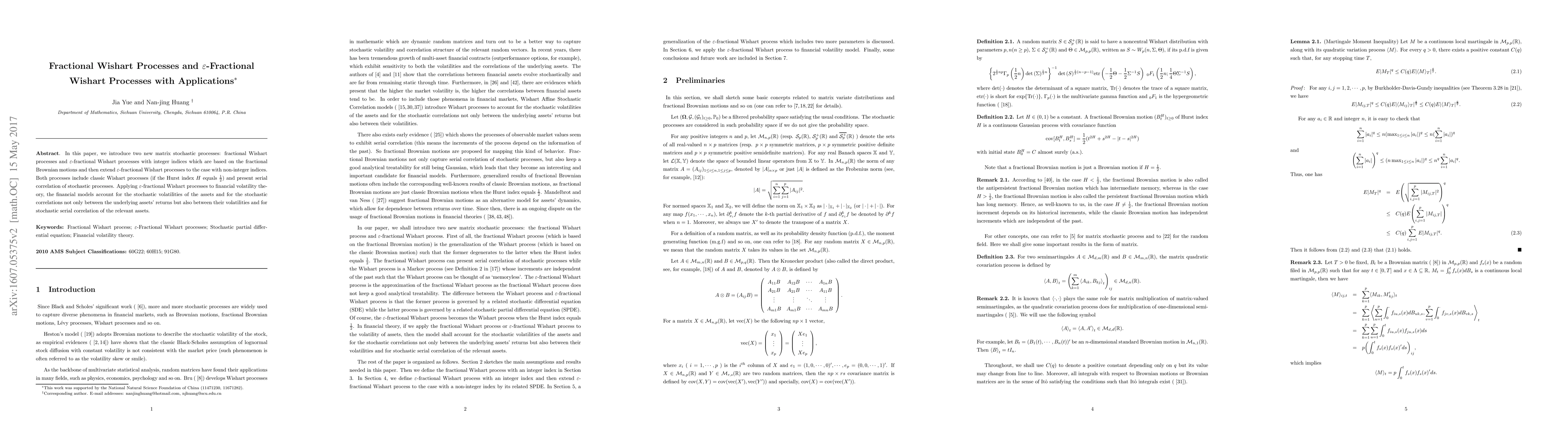

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)