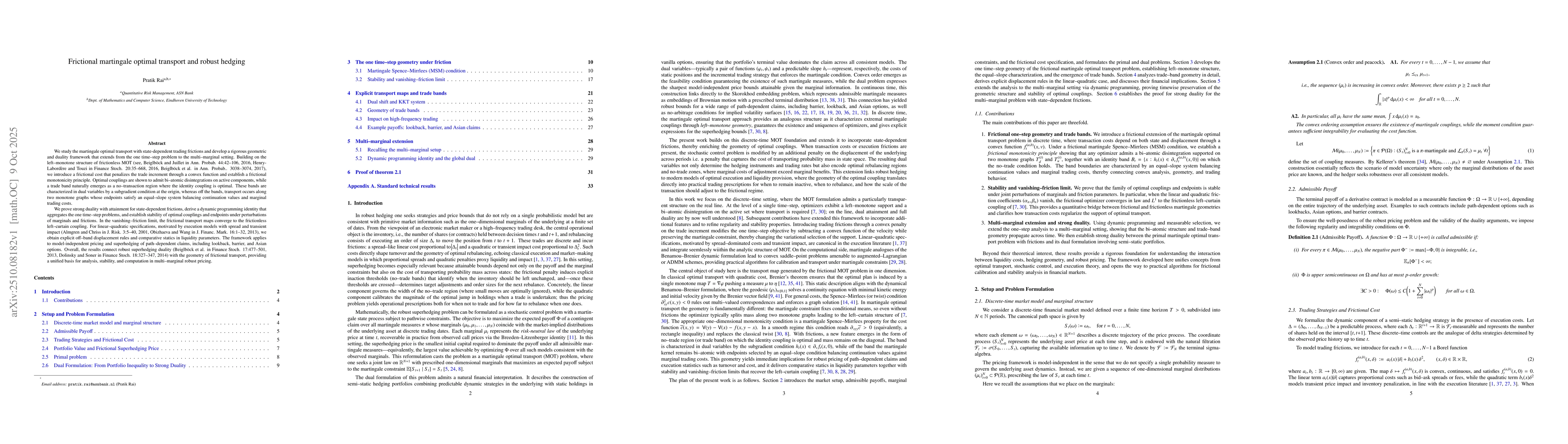

Authors

Summary

We study martingale optimal transport (MOT) with state-dependent trading frictions and develop a geometric-duality framework that extends from one time-step to the multi-marginal setting. Building on the frictionless left-monotone structure (Beiglb\"ock and Juillet, Ann. Probab. 2016; Henry-Labord\`ere and Touzi, Finance Stoch. 2016; Beiglb\"ock et al, Ann. Probab. 2017), we penalize trade increments by a convex cost and prove a frictional monotonicity principle. Optimal couplings admit bi-atomic disintegrations on active components, while a trade band emerges as a no-transaction region where the identity coupling is optimal. The band is characterized in dual variables by a subgradient condition at the origin; off the band, transport moves along two monotone graphs whose endpoints solve an equal-slope system balancing continuation values and marginal trading costs. We establish strong duality with attainment for state-dependent frictions, a dynamic programming identity that aggregates the one time-step problem, and stability of optimal couplings and endpoints under perturbations of marginals and friction. In the vanishing-friction limit the transport maps converge to the frictionless left-curtain coupling. For linear-quadratic frictions, motivated by spread and transient impact (Almgren and Chriss, J. Risk 2001; Obizhaeva and Wang, J. Financ. Mark. 2013), we obtain explicit off-band displacements and comparative statics in liquidity parameters. Applications include model-independent pricing/superhedging of lookback, barrier, and Asian options. Overall, the results link robust superhedging duality (Beiglb\"ock et al, Finance Stoch. 2013; Dolinsky and Soner, Finance Stoch. 2014) with the fine geometry of frictional MOT, providing a unified basis for analysis, stability, and computation in multi-marginal robust pricing.

AI Key Findings

Generated Oct 11, 2025

Methodology

The research employs a multi-step martingale optimal transport framework, integrating state-dependent frictions into the dynamic programming approach. It utilizes the rectangle martingale optimal transport (MSM) condition and derives dual formulations for both single and multi-marginal problems.

Key Results

- Establishes existence of optimal transport plans under state-dependent frictions with left-monotone geometry

- Derives explicit formulas for trade bands and displacement measures in linear-quadratic settings

- Demonstrates time-consistent duality and decomposition for multi-step problems with frictional costs

Significance

This work advances financial mathematics by providing a rigorous framework for pricing and hedging path-dependent derivatives under market frictions. The results have direct applications in optimal execution strategies and risk management.

Technical Contribution

Develops a novel dual formulation for frictional martingale transport problems, establishes existence of optimal solutions with left-monotone structures, and provides explicit characterizations of optimal transport plans through equal-slope conditions.

Novelty

Introduces state-dependent friction modeling within the martingale optimal transport framework, combining dynamic programming with dual formulations for both single and multi-marginal problems in a unified treatment.

Limitations

- Assumes continuous-time martingale constraints which may not capture all market realities

- Focuses primarily on convex order conditions which may limit applicability to certain market structures

Future Work

- Extension to discrete-time models with transaction costs

- Incorporation of liquidity constraints in multi-marginal settings

- Application to high-dimensional derivative pricing problems

Comments (0)