Summary

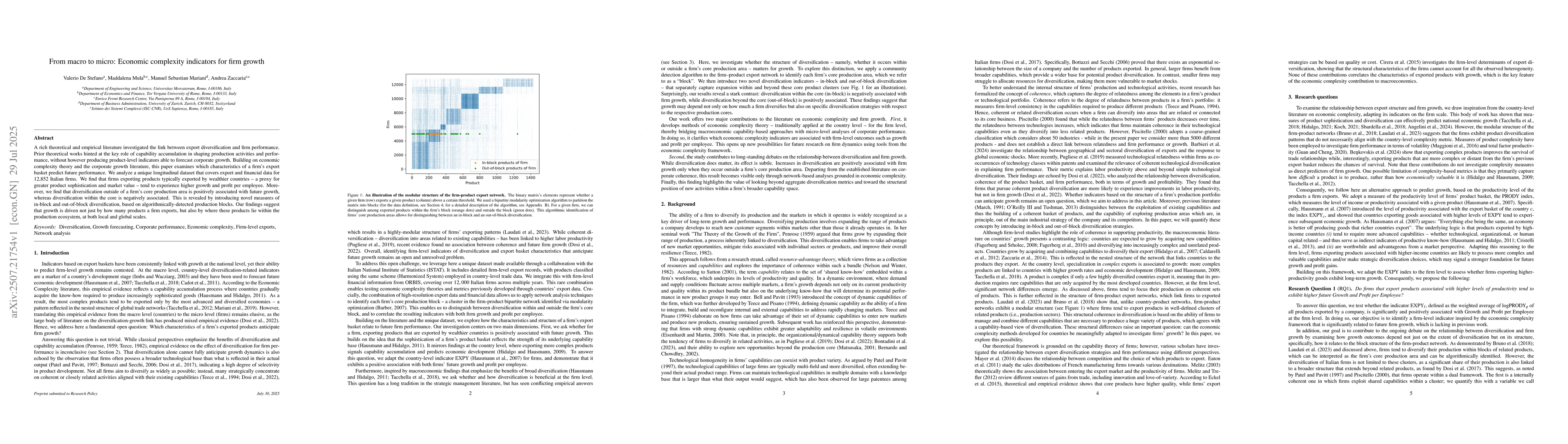

A rich theoretical and empirical literature investigated the link between export diversification and firm performance. Prior theoretical works hinted at the key role of capability accumulation in shaping production activities and performance, without however producing product-level indicators able to forecast corporate growth. Building on economic complexity theory and the corporate growth literature, this paper examines which characteristics of a firm's export basket predict future performance. We analyze a unique longitudinal dataset that covers export and financial data for 12,852 Italian firms. We find that firms exporting products typically exported by wealthier countries -- a proxy for greater product sophistication and market value -- tend to experience higher growth and profit per employee. Moreover, we find that diversification outside of a firm's core production area is positively associated with future growth, whereas diversification within the core is negatively associated. This is revealed by introducing novel measures of in-block and out-of-block diversification, based on algorithmically-detected production blocks. Our findings suggest that growth is driven not just by how many products a firm exports, but also by where these products lie within the production ecosystem, at both local and global scales.

AI Key Findings

Generated Jul 31, 2025

Methodology

The study uses a unique longitudinal dataset of 12,852 Italian firms, analyzing export and financial data. It applies economic complexity theory and introduces novel measures of in-block and out-of-block diversification based on algorithmically-detected production blocks.

Key Results

- Firms exporting products typically exported by wealthier countries experience higher growth and profit per employee.

- Diversification outside of a firm's core production area is positively associated with future growth, while diversification within the core is negatively associated.

- Growth is driven by both the number of products a firm exports and where these products lie within the production ecosystem, at both local and global scales.

Significance

This research contributes to understanding the link between export diversification and firm performance, providing insights for corporate strategies and economic policies.

Technical Contribution

The paper introduces novel measures of in-block and out-of-block diversification, based on algorithmically-detected production blocks, to analyze the relationship between export basket composition and firm growth.

Novelty

This work extends existing literature by connecting micro-level firm growth with economic complexity indicators, revealing that growth is influenced not only by the number of exported products but also by their position within the production ecosystem.

Limitations

- The study focuses on Italian firms, so findings may not be universally applicable to other countries or industries.

- The analysis does not account for potential external factors influencing firm growth and performance.

Future Work

- Further research could explore the applicability of these findings across different countries and industries.

- Investigating the role of firm-level capabilities and resources in conjunction with export basket composition could provide a more comprehensive understanding of firm growth.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExport complexity, industrial complexity and regional economic growth in Brazil

Flávio L. Pinheiro, Ben-Hur Francisco Cardoso, Eva Yamila da Silva Catela et al.

Product-level value chains from firm data: mapping trophic levels into economic growth

Massimiliano Fessina, Andrea Zaccaria, Andrea Tacchella

Multidimensional Economic Complexity and Inclusive Green Growth

César A. Hidalgo, Viktor Stojkoski, Philipp Koch

From Macro to Micro: Boosting micro-expression recognition via pre-training on macro-expression videos

Feng Zhao, Hanting Li, Hongjing Niu

No citations found for this paper.

Comments (0)