Summary

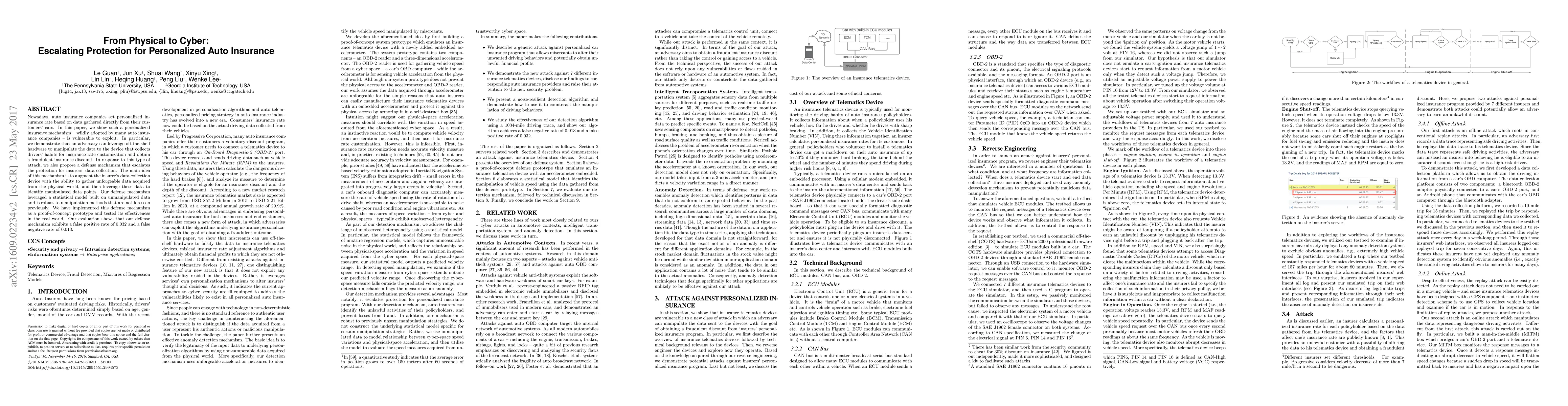

Nowadays, auto insurance companies set personalized insurance rate based on data gathered directly from their customers' cars. In this paper, we show such a personalized insurance mechanism -- wildly adopted by many auto insurance companies -- is vulnerable to exploit. In particular, we demonstrate that an adversary can leverage off-the-shelf hardware to manipulate the data to the device that collects drivers' habits for insurance rate customization and obtain a fraudulent insurance discount. In response to this type of attack, we also propose a defense mechanism that escalates the protection for insurers' data collection. The main idea of this mechanism is to augment the insurer's data collection device with the ability to gather unforgeable data acquired from the physical world, and then leverage these data to identify manipulated data points. Our defense mechanism leveraged a statistical model built on unmanipulated data and is robust to manipulation methods that are not foreseen previously. We have implemented this defense mechanism as a proof-of-concept prototype and tested its effectiveness in the real world. Our evaluation shows that our defense mechanism exhibits a false positive rate of 0.032 and a false negative rate of 0.013.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIncident-Specific Cyber Insurance

Linfeng Zhang, Zhiyu Quan, Wing Fung Chong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)