Authors

Summary

The European Commission's new definition of green hydrogen provides clear guidelines and legal certainty for producers and consumers. However, the strict criteria for electrolysis production, requiring additionality, temporal correlation, and geographical correlation, could increase hydrogen costs, affecting its competitiveness as an energy carrier. This study examines the impact of these European regulations using a stochastic capacity expansion model for the European energy market up to 2048. We analyze how these requirements influence costs and investment decisions. Our results show that green hydrogen production requirements will raise system costs by 82 Euro billion from 2024 to 2048, driven mainly by a rapid transition from fossil fuels to renewable energy. The additionality requirement, which mandates the use of new renewable energy installations for electrolysis, emerges as the most expensive to comply with but also the most effective in accelerating the transition to renewable power, particularly before 2030.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

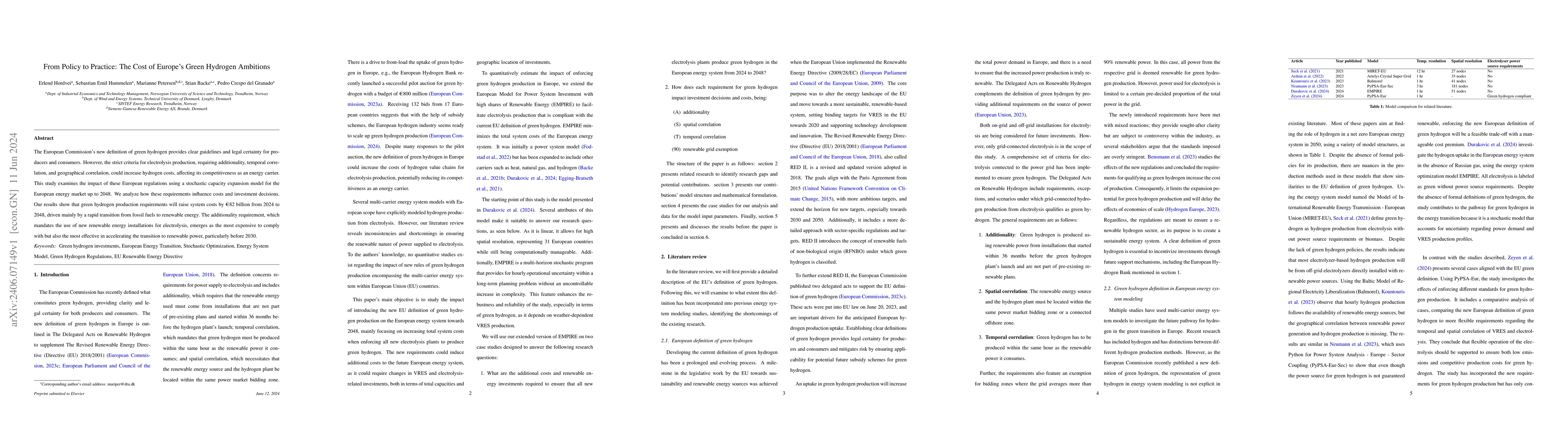

Found 4 papersFrom Policy to Practice. Upper Bound Cost Estimates of Europes Green Hydrogen Ambitions

E. Hordvei, S. Hummelen, M. Petersen et al.

Green Hydrogen Cost-Potentials for Global Trade

Heidi Heinrichs, Jochen Linßen, Detlef Stolten et al.

Mapping Local Green Hydrogen Cost-Potentials by a Multidisciplinary Approach

Heidi Heinrichs, Jochen Linßen, Detlef Stolten et al.

Participatory Mapping of Local Green Hydrogen Cost-Potentials in Sub-Saharan Africa

C. Winkler, H. Heinrichs, S. Ishmam et al.

No citations found for this paper.

Comments (0)