Authors

Summary

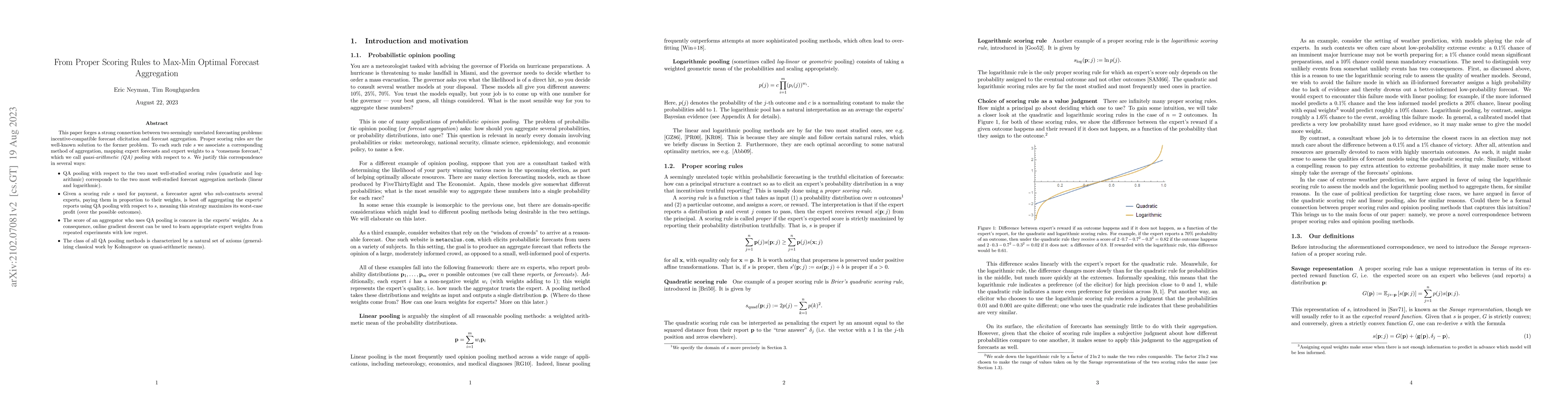

This paper forges a strong connection between two seemingly unrelated forecasting problems: incentive-compatible forecast elicitation and forecast aggregation. Proper scoring rules are the well-known solution to the former problem. To each such rule $s$ we associate a corresponding method of aggregation, mapping expert forecasts and expert weights to a "consensus forecast," which we call *quasi-arithmetic (QA) pooling* with respect to $s$. We justify this correspondence in several ways: - QA pooling with respect to the two most well-studied scoring rules (quadratic and logarithmic) corresponds to the two most well-studied forecast aggregation methods (linear and logarithmic). - Given a scoring rule $s$ used for payment, a forecaster agent who sub-contracts several experts, paying them in proportion to their weights, is best off aggregating the experts' reports using QA pooling with respect to $s$, meaning this strategy maximizes its worst-case profit (over the possible outcomes). - The score of an aggregator who uses QA pooling is concave in the experts' weights. As a consequence, online gradient descent can be used to learn appropriate expert weights from repeated experiments with low regret. - The class of all QA pooling methods is characterized by a natural set of axioms (generalizing classical work by Kolmogorov on quasi-arithmetic means).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProper scoring rules for estimation and forecast evaluation

Johanna Ziegel, Kartik Waghmare

Proper Scoring Rules for Multivariate Probabilistic Forecasts based on Aggregation and Transformation

Romain Pic, Clément Dombry, Philippe Naveau et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)