Summary

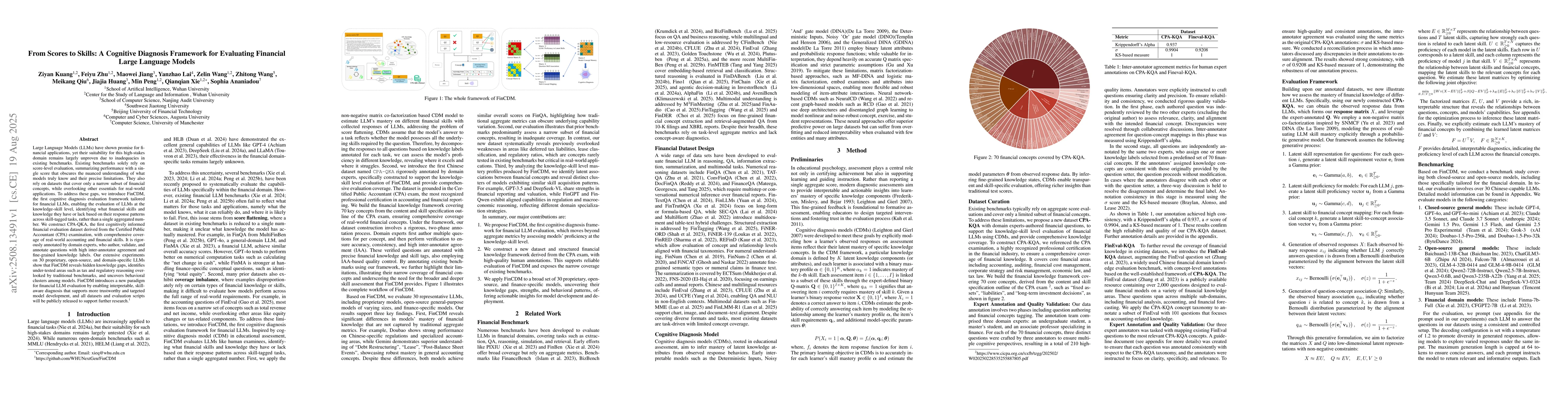

Large Language Models (LLMs) have shown promise for financial applications, yet their suitability for this high-stakes domain remains largely unproven due to inadequacies in existing benchmarks. Existing benchmarks solely rely on score-level evaluation, summarizing performance with a single score that obscures the nuanced understanding of what models truly know and their precise limitations. They also rely on datasets that cover only a narrow subset of financial concepts, while overlooking other essentials for real-world applications. To address these gaps, we introduce FinCDM, the first cognitive diagnosis evaluation framework tailored for financial LLMs, enabling the evaluation of LLMs at the knowledge-skill level, identifying what financial skills and knowledge they have or lack based on their response patterns across skill-tagged tasks, rather than a single aggregated number. We construct CPA-QKA, the first cognitively informed financial evaluation dataset derived from the Certified Public Accountant (CPA) examination, with comprehensive coverage of real-world accounting and financial skills. It is rigorously annotated by domain experts, who author, validate, and annotate questions with high inter-annotator agreement and fine-grained knowledge labels. Our extensive experiments on 30 proprietary, open-source, and domain-specific LLMs show that FinCDM reveals hidden knowledge gaps, identifies under-tested areas such as tax and regulatory reasoning overlooked by traditional benchmarks, and uncovers behavioral clusters among models. FinCDM introduces a new paradigm for financial LLM evaluation by enabling interpretable, skill-aware diagnosis that supports more trustworthy and targeted model development, and all datasets and evaluation scripts will be publicly released to support further research.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research introduces FinCDM, a cognitive diagnosis framework for evaluating financial LLMs at the knowledge-skill level, using CPA-KQA, a cognitively informed financial evaluation dataset derived from the CPA examination.

Key Results

- FinCDM reveals hidden knowledge gaps and identifies under-tested areas like tax and regulatory reasoning overlooked by traditional benchmarks.

- The framework uncovers behavioral clusters among models and provides interpretable, skill-aware diagnosis for more trustworthy and targeted model development.

- Extensive experiments on 30 LLMs show FinCDM's effectiveness in diagnosing model proficiency at the financial concept level.

Significance

FinCDM offers a more informative evaluation than aggregate metrics, uncovering the distribution of overall performance across individual financial concepts, highlighting strengths and blind spots hidden under traditional evaluation methods.

Technical Contribution

FinCDM introduces a novel cognitive diagnosis evaluation framework for financial LLMs, enabling skill-aware diagnosis and interpretable insights into model capabilities.

Novelty

FinCDM distinguishes itself by moving beyond conventional aggregate metrics to diagnose model proficiency at the knowledge-skill level, providing a more nuanced understanding of financial LLM capabilities.

Limitations

- The research focuses on Chinese-capable LLMs, so its applicability to non-Chinese models is uncertain.

- The effectiveness of FinCDM relies on the quality and comprehensiveness of the CPA-KQA dataset, which may limit its generalizability to other financial domains.

Future Work

- Explore multilingual extensions of FinCDM for broader applicability.

- Incorporate multimodal financial content to enhance the framework's capabilities.

Paper Details

PDF Preview

Similar Papers

Found 4 papersInvestigating Large Language Models in Diagnosing Students' Cognitive Skills in Math Problem-solving

Seungju Kim, Juho Kim, Yoonsu Kim et al.

Knowledge is Power: Harnessing Large Language Models for Enhanced Cognitive Diagnosis

Jingyuan Chen, Fei Wu, Zhiang Dong

LLM4CD: Leveraging Large Language Models for Open-World Knowledge Augmented Cognitive Diagnosis

Jianghao Lin, Ruiming Tang, Yong Yu et al.

SCOP: Evaluating the Comprehension Process of Large Language Models from a Cognitive View

Hongru Liang, Wenqiang Lei, Yao Zhang et al.

Comments (0)