Summary

Empirical risk minimization (ERM) is a fundamental learning rule for statistical learning problems where the data is generated according to some unknown distribution $\mathsf{P}$ and returns a hypothesis $f$ chosen from a fixed class $\mathcal{F}$ with small loss $\ell$. In the parametric setting, depending upon $(\ell, \mathcal{F},\mathsf{P})$ ERM can have slow $(1/\sqrt{n})$ or fast $(1/n)$ rates of convergence of the excess risk as a function of the sample size $n$. There exist several results that give sufficient conditions for fast rates in terms of joint properties of $\ell$, $\mathcal{F}$, and $\mathsf{P}$, such as the margin condition and the Bernstein condition. In the non-statistical prediction with expert advice setting, there is an analogous slow and fast rate phenomenon, and it is entirely characterized in terms of the mixability of the loss $\ell$ (there being no role there for $\mathcal{F}$ or $\mathsf{P}$). The notion of stochastic mixability builds a bridge between these two models of learning, reducing to classical mixability in a special case. The present paper presents a direct proof of fast rates for ERM in terms of stochastic mixability of $(\ell,\mathcal{F}, \mathsf{P})$, and in so doing provides new insight into the fast-rates phenomenon. The proof exploits an old result of Kemperman on the solution to the general moment problem. We also show a partial converse that suggests a characterization of fast rates for ERM in terms of stochastic mixability is possible.

AI Key Findings

Generated Sep 02, 2025

Methodology

The paper presents a direct proof of fast rates for ERM in terms of stochastic mixability of (ℓ, F, P), exploiting Kemperman's result on the general moment problem.

Key Results

- A direct proof of fast rates for ERM using stochastic mixability.

- New insights into the fast-rates phenomenon.

- A partial converse suggesting a characterization of fast rates for ERM in terms of stochastic mixability.

- Non-uniqueness of minimizers characterized under certain conditions when stochastic mixability does not hold.

- Weak stochastic mixability concept introduced and analyzed.

Significance

This research provides a deeper understanding of the conditions for fast rates in empirical risk minimization, bridging the gap between statistical learning and non-statistical prediction with expert advice settings.

Technical Contribution

The paper introduces a novel approach to proving fast rates for ERM using stochastic mixability, providing a direct proof that offers new insights into the fast-rates phenomenon.

Novelty

The work builds on classical mixability, offering a fresh perspective by connecting it to stochastic mixability, which characterizes constant regret in simpler non-stochastic settings.

Limitations

- The analysis is primarily theoretical and does not include extensive empirical validation.

- The results are specific to the framework of stochastic mixability and may not generalize easily to other learning settings.

Future Work

- Extending results to nonparametric classes with polynomial metric entropy.

- Investigating the equivalence between stochastic mixability and the Bernstein condition.

- Exploring the implications of the findings for more complex learning problems.

Paper Details

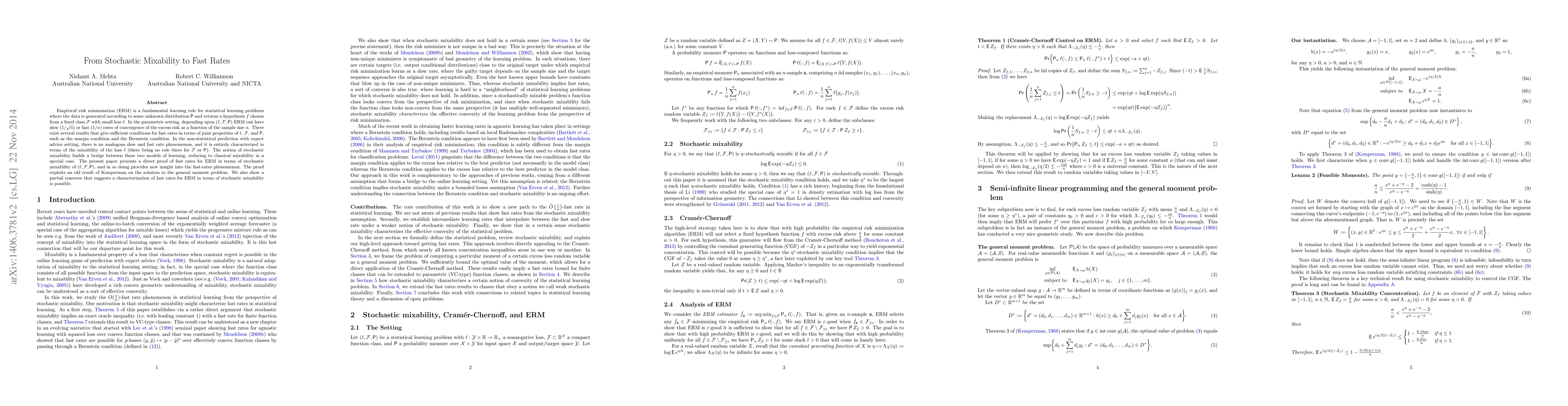

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)