Summary

Decentralized Exchanges (DEXs) are pivotal applications in the Decentralized Finance (DeFi) landscape, aiming to facilitate trustless cryptocurrency trading by relying on smart contracts and blockchain networks. The developments in the DEXs sector began with the implementation of an Automated Market Maker (AMM) system using a simple math formula by Uniswap in 2018. Absorbing significant funding and the attention of web3 enthusiasts, DEXs have seen numerous advancements in their evolution. A notable recent advancement is the introduction of hooks in Uniswap v4, which allows users to take advantage of a wide range of plugin-like features with liquidity pools. This paper provides a comprehensive classification and comparative analyses of prominent DEX protocols, namely Uniswap, Curve, and Balancer, in addition to investigating other protocols' noteworthy aspects. The evaluation framework encompasses mechanisms, components, mathematical formulations, and the performance of liquidity pools. The goals are to elucidate the strengths and limitations of different AMM models, highlight emerging concepts in DEX development, outline current challenges, and differentiate optimal models for specific applications. The results and comparative insights can be a reference for web3 developers, blockchain researchers, traders, and regulatory parties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

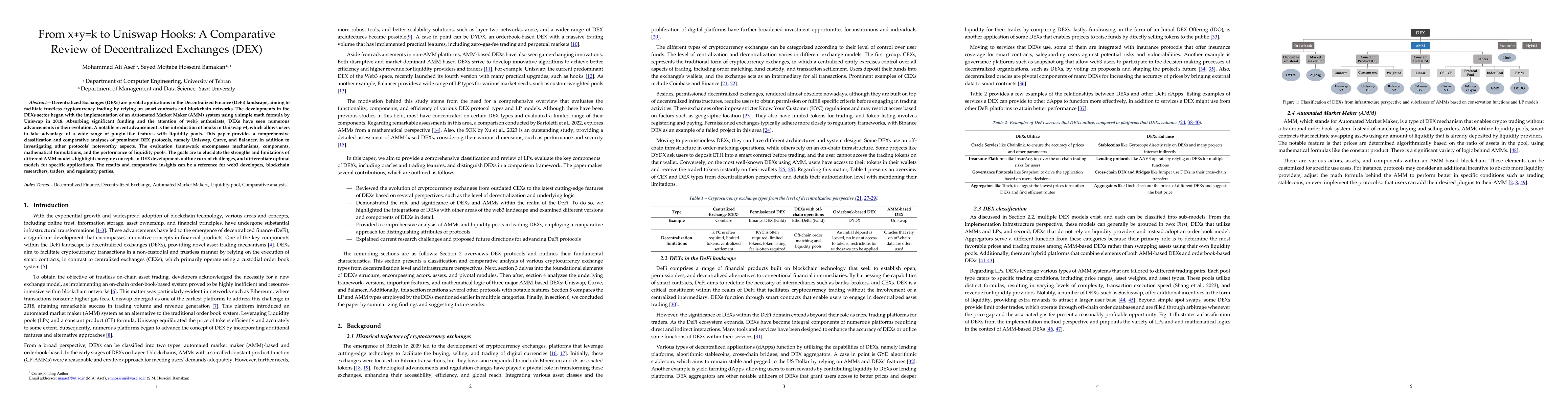

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhat Drives Liquidity on Decentralized Exchanges? Evidence from the Uniswap Protocol

Xin Wan, Ciamac C. Moallemi, Brad Bachu et al.

SoK: Decentralized Exchanges (DEX) with Automated Market Maker (AMM) Protocols

Jiahua Xu, Yebo Feng, Krzysztof Paruch et al.

DEX Specs: A Mean Field Approach to DeFi Currency Exchanges

Erhan Bayraktar, Asaf Cohen, April Nellis

| Title | Authors | Year | Actions |

|---|

Comments (0)