Authors

Summary

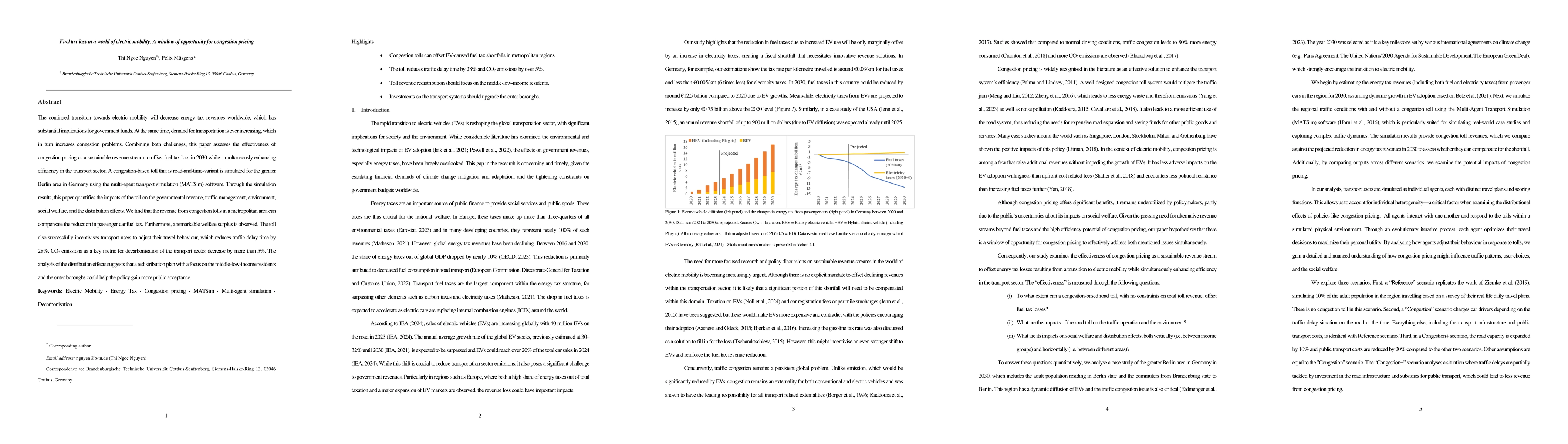

The continued transition towards electric mobility will decrease energy tax revenues worldwide, which has substantial implications for government funds. At the same time, demand for transportation is ever increasing, which in turn increases congestion problems. Combining both challenges, this paper assesses the effectiveness of congestion pricing as a sustainable revenue stream to offset fuel tax loss in 2030 while simultaneously enhancing efficiency in the transport sector. A congestion-based toll that is road-and-time-variant is simulated for the greater Berlin area in Germany using the multi-agent transport simulation (MATSim) software. Through the simulation results, this paper quantifies the impacts of the toll on the governmental revenue, traffic management, environment, social welfare, and the distribution effects. We find that the revenue from congestion tolls in a metropolitan area can compensate the reduction in passenger car fuel tax. Furthermore, a remarkable welfare surplus is observed. The toll also successfully incentivises transport users to adjust their travel behaviour, which reduces traffic delay time by 28%. CO2 emissions as a key metric for decarbonisation of the transport sector decrease by more than 5%. The analysis of the distribution effects suggests that a redistribution plan with a focus on the middle-low-income residents and the outer boroughs could help the policy gain more public acceptance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)